UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-33097

GLADSTONE COMMERCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| MARYLAND | 02-0681276 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1521 WESTBRANCH DRIVE, SUITE 200

MCLEAN, VIRGINIA 22102

(Address of principal executive office)

(703) 287-5800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of Each Class) |

(Name of exchange on which registered) | |

| Common Stock, par value $0.001 per share | NASDAQ Global Select Market | |

| 7.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share |

NASDAQ Global Select Market | |

| 7.50% Series B Cumulative Redeemable Preferred Stock, par value $0.001 per share |

NASDAQ Global Select Market | |

| 7.125% Series C Cumulative Term Preferred Stock, par value $0.001 per share |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | x | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨. | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 30, 2011, based on the closing price on that date of $17.33 on the NASDAQ Global Select Market, was $178,220,819. For the purposes of calculating this amount only, all directors and executive officers of the registrant have been deemed to be affiliates.

The number of shares of the registrant’s Common Stock, $0.001 par value, outstanding as of February 28, 2012 was 10,945,379.

Documents Incorporated by Reference: Portions of the registrant’s Proxy Statement relating to the Registrant’s 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

GLADSTONE COMMERCIAL CORPORATION

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2011

2

Forward-Looking Statements

Our disclosure and analysis in this Annual Report on Form 10-K, or Form 10-K, and the documents that are incorporated by reference herein, contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about possible or assumed future events, including, among other things, discussion and analysis of our future financial condition, results of operations and funds from operations, or FFO, our strategic plans and objectives, cost management, occupancy and leasing rates and trends, liquidity and ability to refinance our indebtedness as it matures, anticipated capital expenditures (and access to capital) required to complete projects, amounts of anticipated cash distributions to our stockholders in the future and other matters. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Statements regarding the following subjects, among others, are forward-looking by their nature:

| • | our business and financing strategy; |

| • | our ability to implement our business plan; |

| • | pending transactions; |

| • | our projected operating results; |

| • | our ability to obtain future financing arrangements; |

| • | estimates relating to our future distributions; |

| • | our understanding of our competition and our ability to compete effectively; |

| • | market and industry trends; |

| • | interest and insurance rates; |

| • | estimates of our future operating expenses, including payments to our Adviser (as defined herein) under the terms of our Advisory Agreement (as defined herein); |

| • | projected capital expenditures; and |

| • | use of the proceeds of our Line of Credit (as defined herein), mortgage notes payable and other future capital resources, if any. |

Forward-looking statements involve inherent uncertainty and may ultimately prove to be incorrect or false. You are cautioned to not place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to:

| • | general volatility of the capital markets and the market price of our common and preferred stock; |

3

| • | risks associated with negotiation and consummation of pending and future transactions; |

| • | changes in our business strategy; |

| • | the adequacy of our cash reserves and working capital; |

| • | our failure to successfully integrate and operate acquired properties and operations; |

| • | defaults upon or non-renewal of leases by tenants; |

| • | decreased rental rates or increased vacancy rates; |

| • | the degree and nature of our competition; |

| • | availability, terms and deployment of capital, including the ability to maintain and borrow under our Line of Credit, arrange for long-term mortgages on our properties, secure one or more additional long-term lines of credit and raise equity capital; |

| • | our ability to identify, hire and retain highly-qualified personnel in the future; |

| • | changes in our industry or the general economy; |

| • | changes in real estate and zoning laws and increases in real property tax rates; |

| • | changes in governmental regulations, tax rates and similar matters; |

| • | environmental uncertainties and risks related to natural disasters; and |

| • | the loss of any of our key employees, such as Mr. David Gladstone, our Chairman and Chief Executive Officer, Mr. Terry Lee Brubaker, our Vice Chairman and Chief Operating Officer, or Mr. George Stelljes III, our President and Chief Investment Officer. |

This list of risks and uncertainties, however, is only a summary of some of the most important factors to us and is not intended to be exhaustive. You should carefully review the risks set forth herein under the caption “Item 1A. Risk Factors.” New factors may also emerge from time to time that could materially and adversely affect us.

Overview

Gladstone Commercial Corporation (which we refer to as “we,” “us,” or the “Company,”) is a real estate investment trust, or REIT, that was incorporated under the General Corporation Laws of the State of Maryland on February 14, 2003 primarily for the purpose of investing in and owning net leased industrial, commercial and retail real property and selectively making long-term industrial and commercial mortgage loans. Our portfolio of real estate is leased to a wide cross section of tenants ranging from small businesses to large public companies, many of which are corporations that do not have publicly rated debt. We have in the past entered into, and intend in the future to enter into, purchase agreements for real estate having triple net leases with terms of approximately 10 to 15 years and built in rental increases. Under a triple net lease, the tenant is required to pay all operating, maintenance and insurance costs and real estate taxes with respect to the leased property. As of February 28, 2012, we own a total of 73 properties.

We conduct substantially all of our activities, including the ownership of all of our properties, through Gladstone Commercial Limited Partnership, a Delaware limited partnership, which we refer to as our

4

Operating Partnership. We control our Operating Partnership through our ownership of GCLP Business Trust II, a Massachusetts business trust, which is the general partner of our Operating Partnership, and of GCLP Business Trust I, a Massachusetts business trust, which currently holds all of the limited partnership units of our Operating Partnership. We expect that our Operating Partnership may issue limited partnership units from time to time in exchange for industrial and commercial real property. Limited partners who hold limited partnership units in our Operating Partnership will generally be entitled to redeem these units for cash or, at our election, shares of our common stock on a one-for-one basis.

Our Operating Partnership is also the sole member of Gladstone Commercial Lending, LLC, which we refer to as Gladstone Commercial Lending. Gladstone Commercial Lending is a Delaware limited liability company that was formed to hold all of our real estate mortgage loans.

Our business is managed by our external adviser, Gladstone Management Corporation, or our Adviser.

Our Investment Objectives and Our Strategy

Our principal investment objectives are to generate income from rental properties and, to a much lesser extent, mortgage loans, which we use to fund our continuing operations and to pay out monthly cash distributions to our stockholders. We intend to grow the distribution to stockholders over time, and to increase the value of our common stock. Our primary strategy to achieve our investment objectives is to invest in and own a diversified portfolio of leased industrial and commercial real estate that we believe will produce stable cash flow and increase in value. We expect to sell some of our real estate assets from time to time when our Adviser determines that doing so would be advantageous to us and our stockholders. We also expect to occasionally make mortgage loans secured by income-producing commercial or industrial real estate, which loans may have some form of equity participation. We currently have no investments in mortgage loans.

We use leverage to make more investments than would otherwise be possible in order to maximize potential returns to stockholders. We are not limited with respect to the amount of leverage that we may use for the acquisition of any specific property. We intend to use non-recourse mortgage financing that will allow us to limit our loss exposure on any property to the amount of equity invested in such property. The market for long-term mortgages has been limited for some time; however, we have recently seen mid-to-long-term (5 to 10 year) mortgages become more obtainable. The collateralized mortgage backed securities, or CMBS, market has been attempting to make a comeback in recent months, but it is much more conservative than it was prior to the recession and the pricing in the market remains volatile. As a result, we will likely not have the same level of access to the CMBS market that we had prior to the recession. Consequently, we are looking to regional banks, insurance companies and other non-bank lenders, and, to a lesser extent, the CMBS market to issue mortgages to finance our real estate activities.

Investment Policies and Policies with Respect to Certain Activities

Types of Investments

Overview

We intend that substantially all of our investments will be generated from the ownership of income-producing real property or, to a much lesser extent, mortgage loans secured by real property. We expect that the vast majority of our investments will be structured as net leases, but if a net lease would have an adverse impact on a potential tenant, or would otherwise be inappropriate for us, we may structure our investment as a mortgage loan. Investments are not restricted to geographical areas, but we expect that most of our investments in real estate will be made within the continental United States. Some of our investments may also be made through joint ventures that would permit us to own interests in large properties without restricting the diversity of our portfolio. Our stockholders are not afforded the opportunity to evaluate the economic merits of our investments or the terms of any dispositions of properties and instead rely on the advice of our Adviser. See “Risk Factors—Our success depends on the performance of our Adviser and if our Adviser makes inadvisable investment or management decisions, our operations could be materially adversely impacted.”

5

We anticipate that we will make substantially all of our investments through our Operating Partnership and Gladstone Commercial Lending. Our Operating Partnership and Gladstone Commercial Lending may acquire interests in real property or mortgage loans in exchange for the issuance of limited partnership units, for cash or through a combination of both. Units issued by our Operating Partnership generally will be redeemable for cash or, at our election, shares of our common stock on a one-for-one basis. However, we may in the future also conduct some of our business and hold some of our interests in real properties or mortgage loans through one or more wholly-owned subsidiaries that are not owned, directly or indirectly, through our Operating Partnership or Gladstone Commercial Lending.

Property Acquisitions and Net Leasing

To date, we have purchased a majority of our properties from owners that have leased their properties to non-affiliated tenants, and while we have engaged in some transactions with tenants who have consummated sale-leaseback transactions, these transactions do not comprise the dominant portion of our portfolio. We expect that some of our sale-leaseback transactions will be in conjunction with acquisitions, recapitalizations or other corporate transactions affecting our tenants. In these transactions, we may act as one of several sources of financing for these transactions by purchasing one or more properties from the tenant and by net leasing it to the tenant or its successor in interest. For a discussion of the risks associated with leasing property to leveraged tenants, see “Risk Factors—Highly leveraged tenants and borrowers may be unable to pay rent or make mortgage payments, which could adversely affect our cash available to make distributions to our stockholders.”

In limited circumstances, we have granted tenants an option to purchase the leased property, and we anticipate granting these options to select tenants in the future. In these cases, we generally seek to fix the option purchase price at the greater of our purchase price for the property and the fair market value of the property at the time the option is exercised.

Our portfolio consists primarily of single-tenant commercial and industrial real property; however, we also own and consider multi-tenant commercial and industrial properties, as well as retail and medical properties. Generally, we lease properties to tenants that our Adviser deems creditworthy under leases that will be full recourse obligations of our tenants or their affiliates. In most cases, our leases will be “triple net leases” that require the tenant to pay all the operating costs, costs of maintenance, insurance and real estate taxes on the property. We seek to obtain lease terms of approximately 10 to 15 years with built-in rental increases.

Investments in Mortgage Loans

Although we expect to make such investments sparingly, we may elect to structure our investment in a particular property as a mortgage loan secured by the property in situations where a standard net lease transaction would have an adverse tax impact on the seller of a property or would otherwise be inappropriate for us. We anticipate that most of our lending transactions will be loans secured by industrial or commercial property. Our Adviser will attempt to structure mortgage loans in a manner that would provide us with current income substantially similar to that which we could expect to receive had the investment been structured as a net lease transaction.

To the extent that we invest in mortgage loans, we will generally originate those loans. However, we may also purchase mortgage loans from banks, CMBS pools, or other lenders if such transactions are consistent with our investment objectives. Our Adviser will service the mortgage loans in our portfolio by monitoring the collection of monthly principal and interest payments on our behalf. There were no mortgage loans outstanding as of December 31, 2011.

6

Underwriting Criteria, Due Diligence Process and Negotiating Lease Provisions

We consider underwriting of the real estate and the tenant for the property (or the borrower in the case of a mortgage loan) to be the most important aspects of making an investment. Evaluating the creditworthiness of the tenant or borrower and its ability to generate sufficient cash flow to make payments to us pursuant to the lease or the mortgage loan is the most important aspect of our underwriting procedures. In analyzing potential acquisitions of properties and leases, our Adviser reviews all aspects of the potential transaction, including tenant and real estate fundamentals, to determine whether potential acquisitions and leases can be structured to satisfy our acquisition criteria. The criteria listed below provide general guideposts that our Adviser may consider when underwriting leases and mortgage loans:

| • | Credit Evaluation. Our Adviser evaluates each potential tenant for its creditworthiness, considering factors such as the rating by a national credit rating agency, if any, management experience, industry position and fundamentals, operating history and capital structure. Currently, 46.0% of our tenants are rated by a national credit rating agency. A prospective tenant that is deemed creditworthy does not necessarily mean that we will consider the tenant’s property to be “investment grade.” Our Adviser seeks tenants that range from small businesses, many of which do not have publicly rated debt, to large public companies. Our Adviser’s investment professionals have substantial experience in locating and financing these types of companies. By leasing properties to these tenants, we believe that we will generally be able to charge rent that is higher than the rent charged to tenants with unleveraged balance sheets and recognized credit, thereby enhancing current return from these properties as compared with properties leased to companies whose credit potential has already been recognized by the market. Furthermore, if a tenant’s credit improves, the value of our lease or investment will likely increase (if all other factors affecting value remain unchanged). In evaluating a possible investment, we believe that the creditworthiness of a prospective tenant is normally a more significant factor than the unleased value of the property itself. While our Adviser selects tenants it believes to be creditworthy, tenants are not required to meet any minimum rating established by an independent credit rating agency. Our Adviser’s standards for determining whether a particular tenant is creditworthy vary in accordance with a variety of factors relating to specific prospective tenants. The creditworthiness of a tenant is determined on a tenant by tenant and case by case basis. Therefore, general standards for creditworthiness cannot be applied. |

| • | Leases with Increasing Rent. Our Adviser seeks to include a clause in each lease that provides for annual rent escalations over the term of the lease. These increases will generally be fixed; however certain leases are tied to increases in indices, such as the consumer price index. |

| • | Diversification. Our Adviser attempts to diversify our portfolio to avoid dependence on any one particular tenant, facility type, geographic location or tenant industry. By diversifying our portfolio, our Adviser intends to reduce the adverse effect of a single under-performing investment or a downturn in any particular industry or geographic region. Total rental income consisted of the following tenant industry classifications as of December 31, 2011 and December 31, 2010: |

| For the year ended December 31, 2011 | For the year ended December 31, 2010 | For the year ended December 31, 2009 | ||||||||||||||||||||||

| (Dollars in Thousands) | (Dollars in Thousands) | (Dollars in Thousands) | ||||||||||||||||||||||

| Industry Classification |

Rental Income | Percentage of Rental Income |

Rental Income | Percentage of Rental Income |

Rental Income | Percentage of Rental Income |

||||||||||||||||||

| Healthcare, Education & Childcare |

$ | 6,467 | 14.7 | % | $ | 6,145 | 14.9 | % | $ | 6,145 | 14.8 | % | ||||||||||||

| Telecommunications |

6,206 | 14.2 | 5,447 | 13.3 | 5,447 | 13.0 | ||||||||||||||||||

| Electronics |

6,046 | 13.9 | 6,165 | 15.0 | 6,165 | 14.9 | ||||||||||||||||||

| Diversified/Conglomerate Manufacturing |

3,664 | 8.4 | 3,665 | 8.9 | 3,664 | 8.8 | ||||||||||||||||||

| Chemicals, Plastics & Rubber |

3,146 | 7.2 | 3,130 | 7.6 | 3,173 | 7.6 | ||||||||||||||||||

| Containers, Packaging & Glass |

2,339 | 5.4 | 2,330 | 5.7 | 2,330 | 5.6 | ||||||||||||||||||

| Personal & Non-Durable Consumer Products |

2,316 | 5.3 | 1,228 | 3.0 | 1,355 | 3.3 | ||||||||||||||||||

| Beverage, Food & Tobacco |

2,271 | 5.2 | 2,189 | 5.3 | 2,189 | 5.3 | ||||||||||||||||||

| Machinery |

2,256 | 5.2 | 2,333 | 5.7 | 2,390 | 5.8 | ||||||||||||||||||

| Buildings and Real Estate |

2,120 | 4.9 | 2,075 | 5.0 | 2,026 | 4.9 | ||||||||||||||||||

| Printing & Publishing |

1,979 | 4.5 | 2,188 | 5.3 | 2,189 | 5.3 | ||||||||||||||||||

| Oil & Gas |

1,271 | 2.9 | 1,283 | 3.1 | 1,138 | 2.7 | ||||||||||||||||||

| Automobile |

1,167 | 2.7 | 1,167 | 2.8 | 1,167 | 2.8 | ||||||||||||||||||

| Diversified/Conglomerate Services |

1,001 | 2.3 | 308 | 0.7 | 308 | 0.8 | ||||||||||||||||||

| Personal, Food & Miscellaneous Services |

649 | 1.5 | 575 | 1.4 | 575 | 1.4 | ||||||||||||||||||

| Home & Office Furnishings |

530 | 1.2 | 530 | 1.3 | 530 | 1.3 | ||||||||||||||||||

| Banking |

204 | 0.5 | — | 0.0 | — | 0.0 | ||||||||||||||||||

| Insurance |

— | 0.0 | 422 | 1.0 | 723 | 1.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 43,632 | 100.0 | % | $ | 41,180 | 100.0 | % | $ | 41,514 | 100.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

7

| • | Property Valuation. The business prospects and the financial strength of the tenant are important aspects of the evaluation of any sale and leaseback of property, or acquisition of property subject to a net lease, particularly a property that is specifically suited to the needs of the tenant. We generally require quarterly unaudited and annual audited financial statements of the tenant in order to continuously monitor the financial performance of the tenant. We evaluate the financial capability of the tenant and its ability to perform per the terms of the lease. We may also examine the available operating results of prospective investment properties to determine whether or not projected rental levels are likely to be met. We then compute the value of the property based on historical and projected operating results. In addition, each property that we propose to purchase is appraised by an independent appraiser. These appraisals may take into consideration, among other things, the terms and conditions of the particular lease transaction and the conditions of the credit markets at the time the purchase is negotiated. We generally limit our property acquisition cost or value to between $3 million and $30 million. |

| • | Properties Important to Tenant Operations. Our Adviser generally seeks to acquire investment properties that are essential or important to the ongoing operations of the prospective tenant. We believe that these investment properties provide better protection in the event a tenant becomes bankrupt, as leases on properties essential or important to the operations of a bankrupt tenant are typically less likely to be rejected in bankruptcy or otherwise terminated. |

| • | Lease Provisions that Enhance and Protect Value. When appropriate, our Adviser attempts to include provisions in our leases that require our consent to specified tenant activity or require the tenant to satisfy specific operating tests. These provisions may include, for example, operational or financial covenants of the tenant, as well as indemnification of us by the tenant against environmental and other contingent liabilities. We believe that these provisions serve to protect our investments from changes in the operating and financial characteristics of a tenant that may impact its ability to satisfy its obligations to us or that could reduce the value of our properties. Our Adviser generally also seeks covenants requiring tenants to receive our consent prior to any change in control of the tenant. |

| • | Credit Enhancement. Our Adviser may also seek to enhance the likelihood of a tenant’s lease obligations being satisfied through a cross-default with other tenant obligations, a letter of credit or a guaranty of lease obligations from each tenant’s corporate parent. We believe that this type of credit enhancement, if obtained, provides us with additional financial security. |

Underwriting of the Real Estate and Due Diligence Process

In addition to underwriting the tenant or borrower, we also underwrite the real estate to be acquired or secured by one of our mortgages. On our behalf, our Adviser performs a due diligence review with respect to each property, such as evaluating the physical condition of a property, zoning and site requirements to ensure the property is in compliance with all zoning regulations as well as an environmental site assessment, in an attempt to determine potential environmental liabilities associated with a property prior to its acquisition, although there can be no assurance that hazardous substances or wastes (as defined by present or future federal or state laws or regulations) will not be discovered on the property after we acquire it. We could incur significant costs related to government regulation and private litigation over environmental matters. See “Risk Factors – We could be exposed to liability and remedial costs related to environmental matters.”

Our Adviser also reviews the structural soundness of the improvements on the property and may engage a structural engineer to review all aspects of the structures in order to determine the longevity of each building on the property. This review normally also includes the components of each building, such as the roof, the electrical wiring, the heating and air-conditioning system, the plumbing, parking lot and various other aspects such as compliance with state and federal building codes.

8

Our Adviser also physically inspects the real estate and surrounding real estate as part of determining the value of the real estate. All of our Adviser’s due diligence is aimed at arriving at a valuation of the real estate under the assumption that it was not rented to the tenant that we are considering. As part of this process, our Adviser may consider one or more of the following items:

| • | The comparable value of similar real estate in the same general area of the prospective property. In this regard, comparable property is difficult to define because each piece of real estate has its own distinct characteristics. But to the extent possible, comparable property in the area that has sold or is for sale will be used to determine if the price to be paid for the property is reasonable. The question of comparable properties’ sale prices is particularly relevant if a property might be sold by us at a later date. |

| • | The comparable real estate rental rates for similar properties in the same area of the prospective property. |

| • | Alternative property uses that may offer higher value. |

| • | The cost of replacing the property if it were to be sold. |

| • | The assessed value as determined by the local real estate taxing authority. |

In addition, our Adviser supplements its valuation with a real estate appraisal in connection with each investment that we consider. When appropriate, our Adviser may engage experts to undertake some or all of the due diligence efforts described above.

Additional Investment Considerations

Terms of Mortgage Loans

Some of the mortgage loans that we may make, purchase or otherwise acquire in the future, in addition to providing for base interest at a fixed or variable rate, may allow us to participate in the economic benefits of any increase in the value of the property securing repayment of the loan as though we were an equity owner of a portion of the property. In addition, it is possible that participation may take other forms where our Adviser deems participation available or otherwise appropriate, provided that such participation does not jeopardize our REIT tax status. The form and extent of our participation, if any, will vary with each transaction depending on factors such as credit support provided by the borrower, the interest rate on our mortgage loans and the anticipated and actual cash flow from the underlying real property. Our mortgage loans may include first mortgage loans, leasehold mortgage loans or conventional mortgage loans without equity enhancements. We have not in the past, nor do we intend in the future to make or invest in sub-prime mortgage loans.

Except as described below, any mortgage loan in our portfolio will generally be secured by real property with demonstrable income-producing potential as well as a security interest in personal or mixed property connected with the real property.

In the event that we make or invest in a mortgage loan, we will generally require a mortgagee’s title insurance policy or commitment as to the lien priority of a mortgage or the condition of title in connection with each mortgage loan. We also may obtain an independent appraisal for underlying real property, that our Adviser may consider when determining whether or not to make or invest in a particular mortgage loan. In making mortgage loans that, when combined with existing loans that are on a parity with or senior to our mortgage loan, exceed 85% of the appraised value of any underlying real property, our Adviser considers additional underwriting criteria such as the net worth of the borrower, the borrower’s credit rating, if any, the anticipated cash flow of the borrower, any additional collateral or other credit enhancements provided by the borrower or its affiliates and other factors our Adviser deems appropriate. Where we think it is

9

appropriate, we may make mortgage loans that are subordinated to a first mortgage on a property. For example, if the property is subject to an economic development loan as a first mortgage at a particularly low interest rate, we may make a second mortgage loan on the property. However, we will not make a second mortgage loan on any property that we would not consider owning, subject to the existing senior financing, and leasing to the tenant.

From time to time, we may purchase mortgage loans, including loans being sold at a discount, from banks and other financial institutions if the subject property otherwise satisfies our underwriting criteria.

Other Investments

Under IRS REIT rules, we may invest up to an aggregate of 10% of our net equity in unimproved or non-income-producing real property and in “equity interests.” “Equity interests” are defined generally to mean stock, warrants or other rights to purchase the stock of, or other equity interests in, a tenant of a property, an entity to which we lend money or a parent or controlling person of a borrower or tenant, and we will not acquire equity interests in any entity other than in connection with a lease or mortgage loan transaction. We anticipate that equity interests will not exceed 5% of our net equity in the aggregate, and we will not make any such investment in equity interests if such investment would adversely affect our qualification as a REIT for tax purposes. To the extent that we hold equity interests in tenants or borrowers, we anticipate that they will generally be “restricted securities” as defined in Rule 144 under the Securities Act. Under this rule, we may be prohibited from reselling the equity securities without limitation until we have fully paid for and held any such securities for one year. The issuer of equity interests, in which we invest, may never register these interests under the federal securities laws, since any decision of an issuer to register its securities may depend on any number of factors, including the success of its operations.

We will generally invest in unimproved or non-income-producing property only when our Adviser believes that such property will appreciate in value or will increase the value of an adjoining or neighboring property that we own.

We might use taxable REIT subsidiaries to acquire or hold property, including equity interests that may not be deemed to be REIT-qualified assets. Taxable REIT subsidiaries are taxed as ordinary corporations and any taxes paid by such entity will reduce cash available to us for payment of distributions to our stockholders.

Joint Ventures

In the future, we may also enter into joint ventures, partnerships and other mutual arrangements with real estate developers, property owners and others for the purpose of obtaining an equity interest in a property in accordance with our investment policies. Joint venture investments could permit us to own interests in large properties without unduly restricting the diversity of our portfolio. We will not enter into a joint venture to make an investment that we would not otherwise purchase on our own under our existing investment policies.

Use of Leverage

Non-recourse Financing

We use long-term mortgage borrowings as a financing mechanism in amounts that we believe will maximize the return to our stockholders. Currently, a majority of our long-term mortgage borrowings are structured as non-recourse to us, and we intend to structure any medium-term mortgages in the same manner, with limited exceptions that would trigger recourse to us only upon the occurrence of certain fraud, misconduct, environmental or bankruptcy events. The use of non-recourse financing allows us to limit our exposure to the amount of equity invested in the properties pledged as collateral for our borrowings. Non-recourse financing generally restricts a lender’s claim on the assets of the borrower, and as a result, the

10

lender generally may look only to the property securing the debt for satisfaction of the debt. We believe that this financing strategy, to the extent available, protects our other assets. However, we can provide no assurance that non-recourse financing will be available on terms acceptable to us, or at all, and there may be circumstances where lenders have recourse to our other assets. There is no limitation on the amount we may borrow against any single investment property. Of the $286.2 million in long-term mortgages outstanding, only $2.0 million is recourse to the Company.

We believe that, by operating on a leveraged basis, we will have more funds available and, therefore, will make more investments than would otherwise be possible if we operated on a non-leveraged basis. We believe that this creates a more diversified portfolio and maximizes potential returns to our stockholders. We may refinance properties during the term of a loan when we believe it is advantageous.

Recourse Financing

Borrowings under our $75.0 million Line of Credit, which is secured by those properties pledged to the borrowing base under the Line of Credit are considered recourse financing, which means that our lenders have a claim against our assets. We intend to use our existing Line of Credit as a warehouse Line of Credit whereby we borrow on a short-term basis until long-term financing can be arranged.

Other Investment Policies

Working Capital Reserves

We may establish a working capital reserve, which we would anticipate to be sufficient to satisfy our liquidity requirements. Our liquidity could be adversely affected by unanticipated costs, greater-than-anticipated operating expenses or cash shortfalls in funding our distributions to stockholders. To the extent that the working capital reserve is insufficient to satisfy our cash requirements, additional funds may be produced from cash generated from operations or through short-term borrowings. In addition, subject to limitations described in this Form 10-K, we may incur indebtedness in connection with:

| • | the acquisition of any property; |

| • | the refinancing of the debt upon any property; or |

| • | the leveraging of any previously unleveraged property. |

For additional information regarding our borrowing strategy, see “- Use of Leverage.”

Holding Period for and Sale of Investments; Reinvestment of Sale Proceeds

We intend to hold each property we acquire for an extended period. However, circumstances might arise which could result in the early sale of some properties if, in the judgment of our Adviser, the sale of the property is in the best interests of us and our stockholders.

The determination of whether a particular property should be sold or otherwise disposed of will be made after consideration of all relevant factors, including prevailing economic conditions, with a view to achieving maximum capital appreciation. The selling price of a property which is subject to a net lease will be determined in large part by the amount of rent payable under the lease, the remaining term of the lease, and the creditworthiness of the tenant. In connection with our sales of properties, we may lend the purchaser all or a portion of the purchase price. In these instances, our taxable income may exceed the cash received by us in connection with any such sale, which could cause us to delay required distributions to our stockholders.

11

The terms of any sale will be dictated by custom in the area in which the property being sold is located and the then-prevailing economic conditions. A decision to provide financing to any purchaser would be made only after an investigation into and consideration of the same factors regarding the purchaser, such as creditworthiness and likelihood of future financial stability, as are undertaken when we consider a net lease or mortgage loan transaction.

We may continually reinvest the proceeds of property sales in investments that either we or our Adviser believe will satisfy our investment policies.

Investment Limitations

There are numerous limitations on the manner in which we may invest our funds, which unless otherwise noted below, may be amended or waived by our Board of Directors at anytime. Our Board of Directors has adopted a policy that we will not:

| • | invest in real property owned by our Adviser, any of its affiliates or any business in which our Adviser or any of its subsidiaries have invested except that we may lease property to existing and prospective portfolio companies of current or future affiliates, such as Gladstone Capital Corporation, Gladstone Investment Corporation and entities advised by our Adviser, so long as that entity does not control the portfolio company and the transaction is approved by both companies’ Board of Directors (this policy may not be changed without the approval of our stockholders); |

| • | invest in commodities or commodity futures contracts, with this limitation not being applicable to futures contracts when used solely for the purpose of hedging in connection with our ordinary business of investing in properties and making mortgage loans; |

| • | invest in contracts for the sale of real estate unless the contract is appropriately recorded in the chain of title; |

| • | invest in any individual property with a cost in excess of 20% of our total assets at the time of investment; |

| • | make investments in unimproved property or indebtedness secured by a deed of trust or mortgage loans on unimproved property in excess of 10% of our total assets. “Unimproved real property” is property which has the following three characteristics: |

| • | the property was not acquired for the purpose of producing rental or other operating income; |

| • | no development or construction is in process on the property; and |

| • | no development or construction on the property is planned in good faith to commence on the property within one year of acquisition; |

| • | issue equity securities on a deferred payment basis or other similar arrangement; |

| • | issue debt securities in the absence of adequate cash flow to cover debt service; |

| • | issue “redeemable securities” as defined in Section 2(a)(32) of the Investment Company Act of 1940; |

| • | grant warrants or options to purchase shares of our stock to our Adviser or its affiliates; |

| • | engage in trading, as compared with investment activities, or engage in the business of underwriting, or the agency distribution of, securities issued by other persons; |

12

| • | acquire securities in any company holding investments or engaging in activities prohibited in the foregoing clauses; or |

| • | make or invest in mortgage loans that are subordinate to any mortgage or equity interest of any of our affiliates. |

Conflict of Interest Policy

We have adopted policies to reduce potential conflicts of interest. In addition, our directors are subject to certain provisions of Maryland law that are designed to minimize conflicts. However, we cannot assure you that these policies or provisions of law will reduce or eliminate the influence of these conflicts.

Under our current conflict of interest policy, without the approval of a majority of our independent directors, we will not:

| • | acquire from or sell to any of our officers, directors or our Adviser’s employees, or any entity in which any of our officers, directors or employees has an interest of more than 5%, any assets or other property; |

| • | borrow from any of our directors, officers or employees, or any entity, in which any of our officers, directors or employees has an interest of more than 5% or; |

| • | engage in any other transaction with any of our directors, officers or employees, or any entity in which any of our directors, officers or employees has an interest of more than 5% (except that our Adviser may lease office space in a building that we own, provided that the rental rate under the lease is determined by our independent directors to be at a fair market rate). |

Our policy also prohibits us from purchasing any real property owned by or co-investing with our Adviser, any of its affiliates or any business in which our Adviser or any of its subsidiaries have invested, except that we may lease property to existing and prospective portfolio companies of current or future affiliates, such as Gladstone Capital Corporation or Gladstone Investment Corporation and other entities advised by our Adviser, so long as that entity does not control the portfolio company and the transaction is approved by both companies’ Board of Directors. If we decide to change this policy on co-investments with our Adviser or its affiliates, we will seek our stockholders’ approval.

Future Revisions in Policies and Strategies

Our independent directors periodically review our investment policies to evaluate whether they are in the best interests of us and our stockholders. Our investment procedures, objectives and policies may vary as new investment techniques are developed or as regulatory requirements change, and except as otherwise provided in our charter or bylaws, may be altered by a majority of our directors (including a majority of our independent directors) without the approval of our stockholders, to the extent that our Board of Directors determines that such modification is in the best interest of our stockholders. Among other factors, developments in the market which affect the policies and strategies described in this report or which change our assessment of the market may cause our Board of Directors to revise our investment policies and strategies.

Our Adviser and Administrator

Our business is managed by Gladstone Management Corporation, or our Adviser. The officers, directors and employees of our Adviser have significant experience in making investments in and lending to businesses of all sizes, including investing in real estate and making mortgage loans. We have entered into the Advisory Agreement (as defined below) with our Adviser under which our Adviser is responsible for managing our assets and liabilities, for operating our business on a day-to-day basis and for identifying,

13

evaluating, negotiating and consummating investment transactions consistent with our investment policies as determined by our Board of Directors from time to time. Gladstone Administrations, LLC, or our Administrator, employs our chief financial officer, chief compliance officer, internal counsel, treasurer, investor relations department and their respective staffs.

David Gladstone, our chairman and chief executive officer, is also the chairman, chief executive officer and the controlling stockholder of our Adviser. Terry Lee Brubaker, our vice chairman, secretary and chief operating officer and a member of our Board of Directors, also serves in the same capacities for our Adviser. George Stelljes III, our president and chief investment officer and a member of our Board of Directors, also serves in the same capacities for our Adviser.

Our Adviser maintains an investment committee that approves each of our investments. This investment committee is comprised of Messrs. Gladstone, Brubaker and Stelljes. We believe that our Adviser’s investment committee review process gives us a unique competitive advantage over other REITs because of the substantial experience and perspective that the members possess in evaluating the blend of corporate credit, real estate and lease terms that combine to provide an acceptable risk for our investments.

Our Adviser’s Board of Directors has empowered its investment committee to authorize and approve our investments, subject to the terms of the Advisory Agreement. Before we acquire any property, the transaction is reviewed by our Adviser’s investment committee to ensure that, in its view, the proposed transaction satisfies our investment criteria and is within our investment policies. Approval by our Adviser’s investment committee is generally the final step in the property acquisition approval process, although the separate approval of our Board of Directors is required in certain circumstances described below. For further detail on this process, please see “Investment Policies and Policies with Respect to Certain Activities - Underwriting Criteria, Due Diligence Process and Negotiating Lease Provisions.”

Our Adviser is headquartered in McLean, Virginia, a suburb of Washington D.C., and also has offices in New York, Connecticut, California and Illinois.

Investment Advisory and Administration Agreements

Many of the services performed by our Adviser and Administrator in managing our day-to-day activities are summarized below. This summary is provided to illustrate the material functions which our Adviser and Administrator perform for us pursuant to the terms of the Advisory and Administration Agreements (as defined below), respectively, but it is not intended to include all of the services which may be provided to us by third parties.

We have an advisory agreement with our Adviser, or the Advisory Agreement, and an administration agreement with our Administrator, or the Administration Agreement.

Investment Advisory Agreement

Under the terms of the Advisory Agreement, we are responsible for all expenses incurred for our direct benefit. Examples of these expenses include legal, accounting, interest on short-term debt and mortgages, tax preparation, directors’ and officers’ insurance, stock transfer services, stockholder-related fees, consulting and related fees. In addition, we are also responsible for all fees charged by third parties that are directly related to our business, which may include real estate brokerage fees, mortgage placement fees, lease-up fees and transaction structuring fees (although we may be able to pass some or all of such fees on to our tenants and borrowers).

During the years ended December 31, 2011, 2010 and 2009, none of these third party expenses were incurred by us directly. The actual amount of such fees that we incur in the future will depend largely upon the aggregate costs of the properties that we acquire, the aggregate amount of mortgage loans that we make and the extent to which we are able to pass on such fees to our tenants and borrowers pursuant to the terms of the agreements. Accordingly, the amount of these fees that we will pay in the future is not determinable at this time.

14

Management Services and Fees under the Advisory Agreement

The Advisory Agreement provides for an annual base management fee equal to 2.0% of our total stockholders’ equity, less the recorded value of any preferred stock, and an incentive fee based on FFO. Our Adviser does not charge acquisition or disposition fees when we acquire or dispose of properties as is common in other externally managed REITs. Furthermore, there are no fees charged when our Adviser secures long or short term credit or arranges mortgage loans on our properties; however, our Adviser may earn fee income from our borrowers or tenants or other sources. This fee income earned by our Adviser, or a portion thereof, may, at the sole discretion of the Board of Directors, be credited against our base management fee as a rebate to the base management fee.

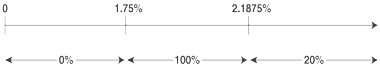

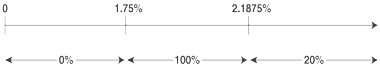

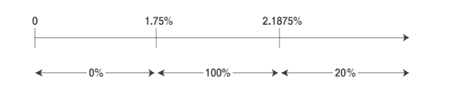

For purposes of calculating the incentive fee, FFO includes any realized capital gains and capital losses, less any distributions paid on preferred stock and senior common stock, but FFO does not include any unrealized capital gains or losses. The incentive fee would reward our Adviser if our quarterly FFO, before giving effect to any incentive fee, or pre-incentive fee FFO, exceeds 1.75%, or the hurdle rate, of total stockholders’ equity, less the recorded value of any preferred stock. We pay our Adviser an incentive fee with respect to our pre-incentive fee FFO in each calendar quarter as follows:

| • | no incentive fee in any calendar quarter in which our pre-incentive fee FFO does not exceed the hurdle rate of 1.75% (7% annualized); |

| • | 100% of the amount of the pre-incentive fee FFO that exceeds the hurdle rate, but is less than 2.1875% in any calendar quarter (8.75% annualized); and |

| • | 20% of the amount of our pre-incentive fee FFO that exceeds 2.1875% in any calendar quarter (8.75% annualized). |

Quarterly Incentive Fee Based on FFO

Pre-incentive fee FFO

(expressed as a percentage of total common stockholders’ equity)

Percentage of pre-incentive fee FFO allocated to incentive fee

The incentive fee may be reduced because of our Line of Credit covenant which limits distributions to our stockholders to 95% of FFO less those acquisition-related costs that are required to be expensed under Accounting Standards Codification, or ASC, 805, Business Combinations.

Administration Agreement

Under the terms of the Administration Agreement, we pay separately for our allocable portion of our Administrator’s overhead expenses in performing its obligations to us including, but not limited to, rent, and our allocable portion of the salaries and benefits expenses of our Administrator’s employees, including, but not limited to, our chief financial officer, chief compliance officer, internal counsel, treasurer, investor relations department and their respective staffs. Our allocable portion of expenses is derived by multiplying our Administrator’s total expenses by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all companies managed by our Adviser under similar agreements.

15

Adviser Duties and Authority under the Advisory Agreement

Under the terms of the Advisory Agreement, our Adviser is required to use its best efforts to present to us investment opportunities consistent with our investment policies and objectives as adopted by our Board of Directors. In performing its duties, our Adviser, either directly or indirectly by engaging an affiliate:

| • | finds, evaluates, and enters into contracts to purchase real estate and make mortgage loans on our behalf in compliance with our investment procedures, objectives and policies, subject to approval of our Board of Directors, where required; |

| • | provides advice to us and acts on our behalf with respect to the negotiation, acquisition, financing, refinancing, holding, leasing and disposition of real estate investments; |

| • | takes the actions and obtains the services necessary to effect the negotiation, acquisition, financing, refinancing, holding, leasing and disposition of real estate investments; and |

| • | provides day-to-day management of our business activities and other administrative services for us as requested by our Board of Directors. |

Our Board of Directors has authorized our Adviser to make investments in any property on our behalf without the prior approval of our board if the following conditions are satisfied:

| • | our Adviser has obtained an independent appraisal for the property indicating that the total cost of the property does not exceed its appraised value; and |

| • | our Adviser has concluded that the property, in conjunction with our other investments and proposed investments, is reasonably expected to fulfill our investment objectives and policies as established by our Board of Directors then in effect. |

The actual terms and conditions of transactions involving investments in properties and mortgage loans are determined in the sole discretion of our Adviser, subject at all times to compliance with the foregoing requirements. Some types of transactions, however, require the prior approval of our Board of Directors, including a majority of our independent directors, including the following:

| • | loans not secured or otherwise supported by real property; |

| • | any acquisition or mortgage loan which at the time of investment would have a cost exceeding 20% of our total assets; |

| • | transactions that involve conflicts of interest with our Adviser (other than reimbursement of expenses in accordance with the Advisory Agreement); and |

| • | the lease of assets to our Adviser, its affiliates or any of our officers or directors. |

Our Adviser and Administrator also engage in other business ventures and, as a result, their resources are not dedicated exclusively to our business. For example, our Adviser and Administrator also serve as the external adviser to Gladstone Capital Corporation and Gladstone Investment Corporation, both publicly traded business development companies affiliated with us, and Gladstone Land Corporation, a private agricultural real estate company. However, under the Advisory Agreement, our Adviser is required to devote sufficient resources to the administration of our affairs to discharge its obligations under the agreement. The Advisory Agreement is not assignable or transferable by either us or our Adviser without

16

the consent of the other party, except that our Adviser may assign the Advisory Agreement to an affiliate for whom our Adviser agrees to guarantee its obligations to us. Either we or our Adviser may assign or transfer the Advisory Agreement to a successor entity.

Dealer Manager Agreement

In connection with the offering of our Senior Common Stock we entered into a Dealer Manager Agreement, dated March 25, 2011 (the “Dealer Manager Agreement”), with Gladstone Securities, LLC (the “Dealer Manager”), pursuant to which the Dealer Manager agreed to act as our exclusive dealer manager in connection with the offering. The Dealer Manager is an affiliate of us, as its parent company is controlled by Mr. David Gladstone, our Chairman and Chief Executive Officer. Pursuant to the terms of the Dealer Manager Agreement, the Dealer Manager is entitled to receive a sales commission in the amount of 7.0% of the gross proceeds of the shares of senior common stock sold, plus a dealer manager fee in the amount of 3.0% of the gross proceeds of the shares of Senior Common Stock sold. In addition, we have agreed to indemnify the Dealer Manager against various liabilities, including certain liabilities arising under the federal securities laws. We made $5 of payments during 2011 to the Dealer Manager pursuant to this agreement.

Employees

We do not currently have any employees and do not expect to have any employees in the foreseeable future. Currently, services necessary for our business are provided by individuals who are employees of our Adviser and our Administrator pursuant to the terms of the Advisory Agreement and the Administration Agreement, respectively. Each of our executive officers is an employee or officer, or both, of our Adviser or our Administrator. No employee of our Adviser or our Administrator will dedicate all of his or her time to us. However, we expect that 15-20 full time employees of our Adviser or our Administrator will spend substantial time on our matters during calendar year 2012. To the extent that we acquire more investments, we anticipate that the number of employees of our Adviser and our Administrator who devote time to our matters will increase.

As of December 31, 2011, our Adviser and our Administrator collectively had 53 full-time employees. A breakdown of these employees is summarized by functional area in the table below:

| Number of Individuals |

Functional Area | |

| 10 |

Executive Management | |

| 32 |

Investment Management, Portfolio Management and Due Diligence | |

| 11 |

Administration, Accounting, Compliance, Human Resources, Legal and Treasury | |

Competition

We compete with a number of other real estate companies and traditional mortgage lenders, many of whom have greater marketing and financial resources than we do. Principal factors of competition in our primary business of investing in and owning leased industrial and commercial real property are the quality of properties, leasing terms, attractiveness and convenience of location. Additionally, our ability to compete depends upon, among other factors, trends of the national and local economies, investment alternatives, financial condition and operating results of current and prospective tenants and borrowers, availability and cost of capital, taxes and governmental regulations.

17

Environmental Matters

As a current and prior owner of real estate, we are subject to various federal, state and local environmental laws, regulations and ordinances and also could be liable to third parties resulting from environmental contamination or noncompliance at our properties. Environmental laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of the contaminants, and the costs of any required investigation or cleanup of these substances can be substantial. The liability is generally not limited under such laws and could exceed the property’s value and the aggregate assets of the liable party. The presence of contamination or the failure to remediate contamination at our properties also may expose us to third-party liability for personal injury or property damage, or adversely affect our ability to sell, lease or develop the real property or to borrow using the real property as collateral. These and other risks related to environmental matters are described in more detail in “Item 1A. – Risk Factors” below.

Available Information

Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments, if any, to those reports filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act are available free of charge through our website at www.GladstoneCommercial.com. A request for any of these reports may also be submitted to us by sending a written request addressed to Investor Relations Manager, Gladstone Commercial Corporation, 1521 Westbranch Drive, Suite 200, McLean, VA 22102, or by calling our toll-free investor relations line at 1-866-366-5745. The public may read and copy materials that we file with the Securities and Exchange Commission, or the SEC, at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

18

An investment in our securities involves a number of significant risks and other factors relating to our structure and investment objectives. As a result, we cannot assure you that we will achieve our investment objectives. You should consider carefully the following information before making an investment in our securities.

Risks related to the economy

The current state of the economy and the capital markets increases the possibility of adverse effects on our financial position, results of operations and the market price of our securities.

Over the last four years, the United States (the “U.S.”) capital markets have experienced significant price volatility and liquidity disruptions, which have caused market prices of many stocks and debt securities to fluctuate substantially and the spreads on prospective debt financings to widen considerably. We believe that it will be a few more years before the U.S. fully recovers from the recession. These circumstances have materially impacted liquidity in the financial markets, making terms for certain financings less attractive, and in certain cases have resulted in the lack of availability of certain types of financing. Continued uncertainty in the stock and credit markets may negatively impact our ability to access additional financing at reasonable terms, which may negatively affect our ability to make acquisitions. These disruptions in the financial markets also may have a material adverse effect on the market value of our common and preferred stock and the lease rates we can charge for our properties, as well as other unknown adverse effects on us or the economy in general. In addition, the continued challenging economic conditions could still materially and adversely impact the financial condition of one or more of our tenants and, therefore, could increase the likelihood that a tenant may declare bankruptcy or default upon its payment obligations arising under a related lease.

The recent downgrade of the U.S. credit rating and the economic crisis in Europe could negatively impact our liquidity, financial condition and earnings.

Recent U.S. debt ceiling and budget deficit concerns, together with signs of deteriorating sovereign debt conditions in Europe, have increased the possibility of additional credit-rating downgrades and economic slowdowns. Although U.S. lawmakers passed legislation to raise the federal debt ceiling, Standard & Poor’s Ratings Services lowered its long-term sovereign credit rating on the U.S. from “AAA” to “AA+” in August 2011. The impact of this or any further downgrades to the U.S. government’s sovereign credit rating, or its perceived creditworthiness, and the impact of the current crisis in Europe with respect to the ability of certain European Union countries to continue to service their sovereign debt obligations is inherently unpredictable and could adversely affect the U.S. and global financial markets and economic conditions. There can be no assurance that governmental or other measures to aid economic recovery will be effective. These developments and the government’s credit concerns in general, could cause interest rates and borrowing costs to rise, which may negatively impact our ability to access the debt markets on favorable terms. In addition, the decreased credit rating could create broader financial turmoil and uncertainty, which may weigh heavily on our stock price. Continued adverse economic conditions could have a material adverse effect on one or more of our tenants, or our business, financial condition and results of operations.

Inflation may adversely affect our financial condition and results of operations.

Although inflation has not materially impacted our results of operations in the past, increased inflation could have a more pronounced negative impact on our results of operations. During times when inflation is greater than increases in rent, as provided for in our leases, rent increases may not keep up with the rate of inflation. Likewise, even though triple net leases reduce our exposure to rising property expenses due to inflation, substantial inflationary pressures and increased costs may have an adverse impact on our tenants if increases in their operating expenses exceed increases in revenue, which may adversely affect the tenants’ ability to pay rent.

19

Risks related to our financing

Our Line of Credit contains various covenants which, if not complied with, could accelerate our repayment obligations, thereby materially and adversely affecting our liquidity, financial condition, results of operations and ability to pay distributions to stockholders.

The agreement governing our Line of Credit requires us to comply with certain financial and operational covenants. These covenants require us to, among other things, maintain certain financial ratios, including fixed charge coverage, debt service coverage and a minimum net worth. We are also required to limit our distributions to stockholders to 95% of our FFO, and continued compliance with this covenant may require us to limit our distributions to stockholders. As of December 31, 2011, we were in compliance with these covenants. However, our continued compliance with these covenants depends on many factors, and could be impacted by current or future economic conditions, and thus there are no assurances that we will continue to comply with these covenants. In addition, we have $45.2 million of mortgage debt maturing in October 2013. Under the terms of the Line of Credit, we must refinance, extend or have enough cash on hand, including availability under our Line of Credit, as of April 2013 or we would be considered in default. Failure to comply with these covenants would result in a default which, if we were unable to obtain a waiver from the lenders, could accelerate our repayment obligations under the Line of Credit and thereby have a material adverse impact on our liquidity, financial condition, results of operations and ability to pay distributions to stockholders.

Our business strategy relies heavily on external financing, which may expose us to risks associated with leverage such as restrictions on additional borrowing and payment of distributions to stockholders, risks associated with balloon payments, and risk of loss of our equity upon foreclosure.

We use leverage so that we may make more investments than would otherwise be possible in order to maximize potential returns to stockholders. If the income generated by our properties and other assets fails to cover our debt service, we could be forced to reduce or eliminate distributions to our stockholders and may experience losses.

Our ability to achieve our investment objectives will be affected by our ability to borrow money in sufficient amounts and on favorable terms. We expect that we will borrow money that will be secured by our properties and that these financing arrangements will contain customary covenants such as those that limit our ability, without the prior consent of the lender, to further mortgage the applicable property or to discontinue insurance coverage. Accordingly, we may be unable to obtain the degree of leverage we believe to be optimal, which may cause us to have less cash for distribution to stockholders than we would have with an optimal amount of leverage. Our use of leverage could also make us more vulnerable to a downturn in our business or the economy, as it may become difficult to meet our debt service obligations if our cash flows are reduced due to tenant defaults. There is also a risk that a significant increase in the ratio of our indebtedness to the measures of asset value used by financial analysts may have an adverse effect on the market price of our securities.

Some of our debt financing arrangements may require us to make lump-sum or “balloon” payments at maturity. Our ability to make a balloon payment at maturity is uncertain and may depend upon our ability to obtain additional financing or to sell the financed property. At the time the balloon payment is due, we may not be able to refinance the balloon payment on terms as favorable as the original loan or sell the property at a price sufficient to make the balloon payment, which could adversely affect the amount of distributions to our stockholders.

We intend to acquire additional properties by using our Line of Credit and by continuing to seek long-term financing, where we will borrow all or a portion of the purchase price of a potential acquisition and securing the loan with a mortgage on some or all of our existing real property. The market for long-term mortgages has been limited for some time; however, we have recently seen mid-to-long-term (5 to 10 year) mortgages become more obtainable. The CMBS market has been attempting to make a comeback in recent months, but it is much more conservative than it was prior to the recession and the pricing in the market

20

remains volatile. As a result, we will likely not have the same level of access to the CMBS market that we had prior to the recession. Consequently, we are looking to regional banks, insurance companies and other non-bank lenders, and, to a lesser extent, the CMBS market to issue mortgages to finance our real estate activities. As of December 31, 2011 we have obtained approximately $285.0 million in long-term financing, which we have used to acquire additional properties. If we are unable to make our debt payments as required, a lender could foreclose on the property securing its loan. This could cause us to lose part or all of our investment in such property which in turn could cause the value of our securities or the amount of distributions to our stockholders to be reduced.

A change in the value of our assets could cause us to experience a cash shortfall, be in default of our loan covenants, lose management control or incur a charge for the impairment of assets.

We borrow on a secured basis under the Line of Credit. A significant reduction in value of the assets secured as collateral could require us to post additional assets or pay down the balance of the Line of Credit. Although we believe that we have significant excess collateral and capacity, future asset values are uncertain. If we were unable to meet a request to add collateral to the Line of Credit, this inability could have a material adverse affect on our liquidity and our ability to meet our loan covenants. We may determine that the value of an individual asset, or group of assets, was impaired, and that we may need to record a charge to write-down the value of the asset to reflect its current estimated value based upon its intended use.

Interest rate changes may adversely affect our results of operations.

We may experience interest rate volatility in connection with mortgage loans on our properties or other variable-rate debt that we may obtain from time to time. Certain of our leases contain escalations based on market interest rates and the interest rate on our existing Line of Credit is variable. Although we seek to mitigate this risk by structuring such provisions to contain a minimum interest rate or escalation rate, as applicable, these features do not eliminate this risk. We are also exposed to the effects of interest rate changes as a result of holding cash and cash equivalents in short-term, interest-bearing investments. We have not entered into any derivative contracts to attempt to further manage our exposure to interest rate fluctuations. A significant change in interest rates could have an adverse impact on our results of operations.

Risks related to the real estate industry

We are subject to certain risks associated with real estate ownership and lending which could reduce the value of our investments.

Our investments include net leased industrial, commercial and retail property. Our performance, and the value of our investments, is subject to risks inherent to the ownership and operation of these types of properties, including:

| • | changes in the general economic climate; |

| • | changes in local conditions such as an oversupply of space or reduction in demand for real estate; |

| • | changes in interest rates and the availability of financing; |

| • | competition from other available space; and |

| • | changes in laws and governmental regulations, including those governing real estate usage, zoning and taxes. |

The debt obligations of our tenants are dependent upon certain factors, which neither we nor our tenants or borrowers control, such as national, local and regional business and economic conditions, government economic policies, and the level of interest rates. As discussed in “Risks related to the economy” above, the credit markets have tightened resulting in a significant contraction in available liquidity. Accordingly, the

21

credit market constraints and recession may increase the operating expenses of our tenants and decrease their ability to make lease payments, and thereby adversely affect our liquidity, financial condition, results of operations and ability to pay distributions to our stockholders.

Competition for the acquisition of real estate may impede our ability to make acquisitions or increase the cost of these acquisitions.

We compete for the acquisition of properties with many other entities engaged in real estate investment activities, including financial institutions, institutional pension funds, other REITs, other public and private real estate companies and private real estate investors. These competitors may prevent us from acquiring desirable properties or may cause an increase in the price we must pay for real estate. Our competitors may have greater resources than we do, and may be willing to pay more for certain assets or may have a more compatible operating philosophy with our acquisition targets. In particular, larger REITs may enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. Our competitors may also adopt transaction structures similar to ours, which would decrease our competitive advantage in offering flexible transaction terms. In addition, the number of entities and the amount of funds competing for suitable investment properties may increase, resulting in increased demand and increased prices paid for these properties.

Our ownership of properties through ground leases exposes us to risks which are different than those resulting from our ownership of fee title to other properties.