UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-33097

GLADSTONE COMMERCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| MARYLAND | 02-0681276 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1521 WESTBRANCH DRIVE, SUITE 100 MCLEAN, VIRGINIA |

22102 | |

| (Address of principal executive offices) | (Zip Code) | |

(703) 287-5800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and formal fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares of the registrant’s Common Stock, $0.001 par value, outstanding as of July 29, 2014 was 17,715,958

GLADSTONE COMMERCIAL CORPORATION

FORM 10-Q FOR THE QUARTER ENDED

JUNE 30, 2014

| PAGE | ||||||

| PART I |

||||||

| Item 1. |

||||||

| Condensed Consolidated Balance Sheets as of June 30, 2014 and December 31, 2013 |

3 | |||||

| 4 | ||||||

| Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2014 and 2013 |

5 | |||||

| 6 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 | ||||

| Item 3. |

42 | |||||

| Item 4. |

43 | |||||

| PART II |

||||||

| Item 1. |

44 | |||||

| Item 1A. |

44 | |||||

| Item 2. |

44 | |||||

| Item 3. |

44 | |||||

| Item 4. |

44 | |||||

| Item 5. |

44 | |||||

| Item 6. |

44 | |||||

| 47 | ||||||

2

PART I – FINANCIAL INFORMATION

Gladstone Commercial Corporation

Condensed Consolidated Balance Sheets

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

| June 30, 2014 | December 31, 2013 | |||||||

| ASSETS |

||||||||

| Real estate, at cost |

$ | 684,001 | $ | 642,353 | ||||

| Less: accumulated depreciation |

88,520 | 81,241 | ||||||

|

|

|

|

|

|||||

| Total real estate, net |

595,481 | 561,112 | ||||||

| Lease intangibles, net |

92,129 | 79,632 | ||||||

| Cash and cash equivalents |

2,367 | 8,546 | ||||||

| Restricted cash |

3,116 | 5,051 | ||||||

| Funds held in escrow |

12,811 | 8,653 | ||||||

| Deferred rent receivable, net |

20,590 | 18,905 | ||||||

| Deferred financing costs, net |

6,678 | 6,840 | ||||||

| Other assets |

2,358 | 1,786 | ||||||

|

|

|

|

|

|||||

| TOTAL ASSETS |

$ | 735,530 | $ | 690,525 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| LIABILITIES |

||||||||

| Mortgage notes payable |

$ | 456,237 | $ | 422,602 | ||||

| Borrowings under line of credit |

25,650 | 24,400 | ||||||

| Series C mandatorily redeemable preferred stock, par value $0.001 per share; $25 per share liquidation preference; 1,700,000 shares authorized; and 1,540,000 shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

38,500 | 38,500 | ||||||

| Deferred rent liability, net |

5,703 | 6,015 | ||||||

| Asset retirement obligation |

3,747 | 3,884 | ||||||

| Accounts payable and accrued expenses |

6,498 | 2,359 | ||||||

| Due to Adviser and Administrator (1) |

1,737 | 1,360 | ||||||

| Other liabilities |

6,908 | 8,259 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

$ | 544,980 | $ | 507,379 | ||||

|

|

|

|

|

|||||

| Commitments and contingencies (2) |

||||||||

| STOCKHOLDERS’ EQUITY |

||||||||

| Series A and B redeemable preferred stock, par value $0.001 per share; $25 per share liquidation preference; 2,300,000 shares authorized and 2,150,000 shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

$ | 2 | $ | 2 | ||||

| Senior common stock, par value $0.001 per share; 7,500,000 shares authorized and 441,774 and 374,484 shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

— | — | ||||||

| Common stock, par value $0.001 per share, 38,500,000 shares authorized and 17,715,958 and 15,662,414 shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

18 | 16 | ||||||

| Additional paid in capital |

332,850 | 298,751 | ||||||

| Notes receivable - employee |

(375 | ) | (375 | ) | ||||

| Distributions in excess of accumulated earnings |

(141,945 | ) | (115,248 | ) | ||||

|

|

|

|

|

|||||

| Total Stockholders’ Equity |

190,550 | 183,146 | ||||||

|

|

|

|

|

|||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ | 735,530 | $ | 690,525 | ||||

|

|

|

|

|

|||||

| (1) | Refer to Note 2 “Related-Party Transactions” |

| (2) | Refer to Note 8 “Commitments and Contingencies” |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Gladstone Commercial Corporation

Condensed Consolidated Statements of Operations

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Operating revenues |

||||||||||||||||

| Rental revenue |

$ | 17,620 | $ | 14,190 | $ | 34,205 | $ | 27,856 | ||||||||

| Tenant recovery revenue |

770 | 68 | 1,321 | 437 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating revenues |

18,390 | 14,258 | 35,526 | 28,293 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses |

||||||||||||||||

| Depreciation and amortization |

6,871 | 5,220 | 13,591 | 10,121 | ||||||||||||

| Property operating expenses |

1,302 | 564 | 2,632 | 1,300 | ||||||||||||

| Acquisition related expenses |

859 | 274 | 970 | 459 | ||||||||||||

| Base management fee (1) |

666 | 451 | 1,291 | 804 | ||||||||||||

| Incentive fee (1) |

1,527 | 933 | 2,767 | 1,864 | ||||||||||||

| Administration fee (1) |

485 | 367 | 977 | 730 | ||||||||||||

| General and administrative |

490 | 477 | 957 | 866 | ||||||||||||

| Impairment charge |

— | — | 13,958 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses before credit to incentive fee |

12,200 | 8,286 | 37,143 | 16,144 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Credit to incentive fee (1) |

(957 | ) | (917 | ) | (2,162 | ) | (1,502 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

11,243 | 7,369 | 34,981 | 14,642 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expense) |

||||||||||||||||

| Interest expense |

(6,509 | ) | (5,764 | ) | (12,784 | ) | (11,425 | ) | ||||||||

| Distributions attributable to Series C mandatorily redeemable preferred stock |

(686 | ) | (686 | ) | (1,372 | ) | (1,372 | ) | ||||||||

| Gain on sale of real estate |

1,240 | — | 1,240 | — | ||||||||||||

| Other income |

27 | 12 | 74 | 29 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expense |

(5,928 | ) | (6,438 | ) | (12,842 | ) | (12,768 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

1,219 | 451 | (12,297 | ) | 883 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions attributable to Series A and B preferred stock |

(1,023 | ) | (1,023 | ) | (2,047 | ) | (2,047 | ) | ||||||||

| Distributions attributable to senior common stock |

(110 | ) | (69 | ) | (210 | ) | (122 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) available (attributable) to common stockholders |

$ | 86 | $ | (641 | ) | $ | (14,554 | ) | $ | (1,286 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per weighted average share of common stock - basic & diluted |

||||||||||||||||

| Income (loss) from continuing operations (net of dividends attributable to preferred stock) |

$ | 0.01 | $ | (0.05 | ) | $ | (0.90 | ) | $ | (0.11 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) available to common stockholders |

$ | 0.01 | $ | (0.05 | ) | $ | (0.90 | ) | $ | (0.11 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares of common stock outstanding |

||||||||||||||||

| Basic |

16,547,793 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

16,894,973 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per weighted average share of senior common stock |

$ | 0.26 | $ | 0.26 | $ | 0.52 | $ | 0.52 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares of senior common stock outstanding - basic |

421,312 | 261,754 | 404,243 | 233,633 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Refer to Note 2 “Related-Party Transactions” |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Gladstone Commercial Corporation

Condensed Consolidated Statements of Cash Flows

(Dollars in Thousands)

(Unaudited)

| For the six months ended June 30, | ||||||||

| 2014 | 2013 | |||||||

| Cash flows from operating activities: |

||||||||

| Net (loss) income |

$ | (12,297 | ) | $ | 883 | |||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

13,591 | 10,121 | ||||||

| Impairment charge |

13,958 | — | ||||||

| Gain on sale of real estate |

(1,240 | ) | — | |||||

| Amortization of deferred financing costs |

795 | 817 | ||||||

| Amortization of deferred rent asset and liability, net |

(178 | ) | (157 | ) | ||||

| Amortization of discount and premium on assumed debt |

(114 | ) | (85 | ) | ||||

| Asset retirement obligation expense |

(137 | ) | 64 | |||||

| Increase in other assets |

(372 | ) | (218 | ) | ||||

| Increase in deferred rent receivable |

(1,778 | ) | (1,689 | ) | ||||

| Decrease in accounts payable, accrued expenses, and amount due Adviser and Administrator |

(1,004 | ) | (1,664 | ) | ||||

| Increase (decrease) in other liabilities |

585 | (139 | ) | |||||

| Leasing commissions paid |

(765 | ) | (394 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

11,044 | 7,539 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Acquisition of real estate and related intangible assets |

(64,764 | ) | (33,488 | ) | ||||

| Improvements of existing real estate |

(2,934 | ) | (3,999 | ) | ||||

| Proceeds from sale of real estate |

11,162 | — | ||||||

| Receipts from lenders for funds held in escrow |

1,287 | 1,529 | ||||||

| Payments to lenders for funds held in escrow |

(5,445 | ) | (1,645 | ) | ||||

| Receipts from tenants for reserves |

1,519 | 2,261 | ||||||

| Payments to tenants from reserves |

(3,423 | ) | (1,158 | ) | ||||

| Decrease (increase) in restricted cash |

1,935 | (1,103 | ) | |||||

| Deposits on future acquisitions |

(1,500 | ) | (725 | ) | ||||

| Deposits applied against real estate investments |

1,300 | — | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(60,863 | ) | (38,328 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from issuance of equity |

36,042 | 57,219 | ||||||

| Offering costs |

(2,028 | ) | (3,183 | ) | ||||

| Borrowings under mortgage notes payable |

27,535 | 3,700 | ||||||

| Payments for deferred financing costs |

(633 | ) | (209 | ) | ||||

| Principal repayments on mortgage notes payable |

(4,182 | ) | (3,560 | ) | ||||

| Principal repayments on employee notes receivable |

— | 35 | ||||||

| Borrowings from line of credit |

44,250 | 23,700 | ||||||

| Repayments on line of credit |

(43,000 | ) | (37,500 | ) | ||||

| Decrease in security deposits |

(31 | ) | — | |||||

| Distributions paid for common, senior common and preferred stock |

(14,313 | ) | (10,936 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

43,640 | 29,266 | ||||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(6,179 | ) | (1,523 | ) | ||||

| Cash and cash equivalents, beginning of period |

8,546 | 5,546 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 2,367 | $ | 4,023 | ||||

|

|

|

|

|

|||||

| NON-CASH OPERATING, INVESTING AND FINANCING INFORMATION |

||||||||

| Fixed rate principal debt assumed in connection with acquisitions |

$ | 10,147 | $ | — | ||||

|

|

|

|

|

|||||

| Senior common dividend issued in the dividend reinvestment program |

$ | 87 | $ | 52 | ||||

|

|

|

|

|

|||||

| Capital improvements included in accounts payable and accrued expenses |

$ | 5,521 | $ | — | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Gladstone Commercial Corporation

Notes to Consolidated Financial Statements (Unaudited)

1. Organization, Basis of Presentation and Significant Accounting Policies

Gladstone Commercial Corporation, is a real estate investment trust, or REIT, that was incorporated under the General Corporation Laws of the State of Maryland on February 14, 2003 primarily for the purpose of investing in and owning net leased industrial, commercial and retail real property and selectively making long-term industrial and commercial mortgage loans. Subject to certain restrictions and limitations, our business is managed by Gladstone Management Corporation, a Delaware corporation, or the Adviser, and administrative services are provided by Gladstone Administration, LLC, a Delaware limited liability company, or the Administrator, each pursuant to a contractual arrangement with us. Our Adviser and Administrator collectively employ all of our personnel and pay their salaries, benefits, and general expenses directly.

Subsidiaries

We conduct substantially all of our operations through a subsidiary, Gladstone Commercial Limited Partnership, a Delaware limited partnership, or the Operating Partnership. As we currently own all of the general and limited partnership interests of the Operating Partnership through two of our subsidiaries, GCLP Business Trust I and II, the financial position and results of operations of the Operating Partnership are consolidated with those of the Company.

Gladstone Commercial Lending, LLC, a Delaware limited liability company, or Gladstone Commercial Lending, a subsidiary of ours, was created to conduct all operations related to real estate mortgage loans of the Company. As the Operating Partnership currently owns all of the membership interests of Gladstone Commercial Lending, the financial position and results of operations of Gladstone Commercial Lending are consolidated with ours.

Gladstone Commercial Advisers, Inc., a Delaware corporation, or Commercial Advisers, and a wholly-owned subsidiary of ours, is a taxable REIT subsidiary, or TRS, which was created to collect any non-qualifying income related to our real estate portfolio. There has been no such income earned to date. Since we own 100% of the voting securities of Commercial Advisers, the financial position and results of operations of Commercial Advisers are consolidated with ours.

GCLP Business Trust I and GCLP Business Trust II, each a subsidiary and business trust of ours, were formed under the laws of the Commonwealth of Massachusetts on December 28, 2005. We transferred our 99% limited partnership interest in the Operating Partnership to GCLP Business Trust I in exchange for 100 shares of the trust. Gladstone Commercial Partners, LLC transferred its 1% general partnership interest in the Operating Partnership to GCLP Business Trust II in exchange for 100 trust shares.

All further references herein to “we,” “our,” “us” and the “Company” mean Gladstone Commercial Corporation and its consolidated subsidiaries, except where it is made clear that the term means only Gladstone Commercial Corporation.

Interim Financial Information

Our interim financial statements are prepared in accordance with U.S. generally accepted accounting principles, or GAAP, for interim financial information and pursuant to the requirements for reporting on Form 10-Q and in accordance with Article 10 of Regulation S-X. Accordingly, certain disclosures

6

accompanying annual financial statements prepared in accordance with GAAP are omitted. The year-end balance sheet data presented herein was derived from audited financial statements, but does not include all disclosures required by GAAP. In the opinion of our management, all adjustments, consisting solely of normal recurring accruals, necessary for the fair presentation of financial statements for the interim period have been included. The interim financial statements and notes thereto should be read in conjunction with the financial statements and notes thereto included in our Form 10-K for the year ended December 31, 2013, as filed with the U.S. Securities and Exchange Commission on February 18, 2014. The results of operations for the three and six months ended June 30, 2014 are not necessarily indicative of the results that may be expected for other interim periods or for the full fiscal year.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could materially differ from those estimates.

Real Estate and Lease Intangibles

We record investments in real estate at cost and capitalize improvements and replacements when they extend the useful life or improve the efficiency of the asset. We expense costs of repairs and maintenance as such costs are incurred. We compute depreciation using the straight-line method over the estimated useful life, or 39 years, for buildings and improvements, 5 to 20 years for equipment and fixtures, and the shorter of the useful life or the remaining lease term for tenant improvements and leasehold interests.

Certain of our acquisitions involve sale-leaseback transactions with newly-originated leases, which we account for as asset acquisitions under Accounting Standards Codification, or ASC, 805, “Business Combinations.” In the case of an asset acquisition, we will capitalize the transaction costs incurred in connection with the acquisition. Other of our acquisitions involve the acquisition of properties that are already being operated as rental properties, which we will generally consider to be a business combination under ASC 805. Business combination guidance is generally applicable to us when properties are acquired with leases in place at the time of acquisition. When an acquisition is considered a business combination, ASC 805 requires that the purchase price of real estate be allocated to the acquired tangible assets and liabilities, consisting of land, building, tenant improvements, long-term debt assumed and identified intangible assets and liabilities, typically the value of above-market and below-market leases, the value of in-place leases, the value of unamortized lease origination costs and the value of tenant relationships, based in each case on their fair values. ASC 805 also requires that all expenses related to an acquisition accounted for as a business combination to be expensed as incurred, rather than capitalized into the cost of the acquisition.

Management’s estimates of fair value are made using methods similar to those used by independent appraisers (e.g. discounted cash flow analysis). Factors considered by management in its analysis include an estimate of carrying costs during hypothetical expected lease-up periods considering current market conditions and costs to execute similar leases. We also consider information obtained about each property as a result of our pre-acquisition due diligence, marketing and leasing activities in estimating the fair value of the tangible and intangible assets acquired and liabilities assumed. In estimating carrying costs, management also includes lost reimbursement of real estate taxes, insurance and other operating expenses as well as estimates of lost rentals at market rates during the hypothetical expected lease-up periods, which primarily range from 9 to 18 months, depending on specific local market conditions. Management also estimates costs to execute similar leases, including leasing commissions, legal and other related expenses to the extent that such costs are not already incurred in connection with a new lease origination as part of the transaction.

We allocate purchase price to the fair value of the tangible assets of an acquired property by valuing the property as if it were vacant. The “as-if-vacant” value is allocated to land, building and tenant improvements based on management’s determination of the relative fair values of these assets. Real estate

7

depreciation expense on these tangible assets was $4.6 million and $9.0 million for the three and six months ended June 30, 2014, respectively, and $3.6 million and $7.0 million for the three and six months ended June 30, 2013, respectively.

Above-market and below-market in-place lease fair values for owned properties are recorded based on the present value (using an interest rate which reflects the risks associated with the leases acquired) of the difference between (i) the contractual amounts to be paid pursuant to the in-place leases and (ii) management’s estimate of fair market lease rates for the corresponding in-place leases, measured over a period equal to the remaining non-cancelable term of the lease. When determining the non-cancelable term of the lease, we evaluate if fixed-rate renewal options, if any, should be included. The capitalized above-market lease values, included in the accompanying condensed consolidated balance sheets as part of deferred rent receivable, are amortized as a reduction of rental income over the remaining non-cancelable terms of the respective leases. Total amortization related to above-market lease values was $0.1 million for both the three and six months ended June 30, 2014 and 2013, respectively. The capitalized below-market lease values, included in the accompanying condensed consolidated balance sheets as part of deferred rent liability, are amortized as an increase to rental income over the remaining non-cancelable terms of the respective leases, including any below market renewal periods. Total amortization related to below-market lease values was $0.2 million and $0.3 million for the three and six months ended June 30, 2014, respectively, and $0.1 million and $0.3 million for the three and six months ended June 30, 2013, respectively.

The total amount of the remaining intangible assets acquired, which consists of in-place lease values, unamortized lease origination costs, and customer relationship intangible values, are allocated based on management’s evaluation of the specific characteristics of each tenant’s lease and our overall relationship with that respective tenant. Characteristics to be considered by management in determining these values include the nature and extent of our existing business relationships with the tenant, growth prospects for developing new business with the tenant, the tenant’s credit quality and our expectations of lease renewals (including those existing under the terms of the lease agreement), among other factors.

The value of in-place leases and lease origination costs are amortized to expense over the remaining term of the respective leases, which generally range from 10 to 15 years. The value of customer relationship intangibles, which is the benefit to us resulting from the likelihood of an existing tenant renewing its lease, are amortized to expense over the remaining term and any anticipated renewal periods in the respective leases, but in no event does the amortization period for intangible assets exceed the remaining depreciable life of the building. Should a tenant terminate its lease, the unamortized portion of the above-market and below-market lease values would be charged to rental income and the unamortized portion of in-place lease values, lease origination costs and customer relationship intangibles will be immediately charged to amortization expense. Total amortization expense related to these intangible assets and liabilities was $2.3 million and $4.7 million for the three and six months ended June 30, 2014, respectively, and $1.6 million and $3.1 million for the three and six months ended June 30, 2013, respectively.

Impairment Charges

We account for the impairment of real estate, including intangible assets, in accordance with ASC 360-10-35, “Property, Plant, and Equipment,” which requires us to periodically review the carrying value of each property to determine if circumstances indicate impairment of the carrying value of the investment exists or that depreciation periods should be modified. If circumstances indicate the possibility of impairment, we prepare a projection of the undiscounted future cash flows, without interest charges, of the specific property and determine if the carrying value of the investment in such property is recoverable. In performing the analysis, we consider such factors as each tenant’s payment history and financial condition, the likelihood of lease renewal, business conditions in the industry in which the tenants operate, whether there are indications that the fair value of the real estate has decreased and our intended holding period of the property. If the carrying amount is more than the aggregate undiscounted future cash flows, we would recognize an impairment loss to the extent the carrying amount exceeds the estimated fair value, less cost to sell, of the property. We evaluate our entire portfolio of properties each quarter for any impairment indicators and perform an impairment analysis on those select properties that have an indication of impairment.

8

Deferred Financing Costs

Deferred financing costs consist of costs incurred to obtain financing, including legal fees, origination fees and administrative fees. The costs are deferred and amortized using the straight-line method, which approximates the effective interest method, over the term of the secured financing. We made payments of $0.3 million and $0.6 million for deferred financing costs during the three and six months ended June 30, 2014, respectively, and payments of $0.1 million and $0.2 million during the three and six months ended June 30, 2013, respectively. Total amortization expense related to deferred financing costs is included in interest expense and was $0.4 million and $0.8 million for both the three and six months ended June 30, 2014 and 2013, respectively.

Revenue Recognition

Rental revenue includes rents that each tenant pays in accordance with the terms of its respective lease reported evenly over the non-cancelable term of the lease. Most of our leases contain rental increases at specified intervals. We recognize such revenues on a straight-line basis. Deferred rent receivable in the accompanying condensed consolidated balance sheet includes the cumulative difference between rental revenue, as recorded on a straight-line basis, and rents received from the tenants in accordance with the lease terms, along with the capitalized above-market in-place lease values of certain acquired properties. Accordingly, we determine, in our judgment, to what extent the deferred rent receivable applicable to each specific tenant is collectable. We review deferred rent receivable, as it relates to straight line rents, on a quarterly basis and take into consideration the tenant’s payment history, the financial condition of the tenant, business conditions in the industry in which the tenant operates and economic conditions in the geographic area in which the property is located. In the event that the collectability of deferred rent with respect to any given tenant is in doubt, we record an allowance for uncollectable accounts or record a direct write-off of the specific rent receivable. No such reserves or direct write-offs have been recorded to date.

Tenant recovery revenue includes payments from tenants as reimbursements for franchise taxes, management fees, insurance, and ground lease payments. We recognize tenant recovery revenue in the same periods that we incur the related expenses.

Asset Retirement Obligations

ASC 410, “Asset Retirement and Environmental Obligation,” requires an entity to recognize a liability for a conditional asset retirement obligation when incurred if the liability can be reasonably estimated. ASC 410-20-20 clarifies that the term “Conditional Asset Retirement Obligation” refers to a legal obligation (pursuant to existing laws or by contract) to perform an asset retirement activity in which the timing and/or method of settlement are conditional on a future event that may or may not be within the control of the entity. ASC 410-20-25-6 clarifies when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement obligation. We have accrued a liability and corresponding increase to the cost of the related properties for disposal related to all properties constructed prior to 1985 that have, or may have, asbestos present in the building. The liabilities are accreted over the life of the leases for the respective properties. There were no liabilities accrued during the six months ended June 30, 2014 and 2013, respectively. We recorded expenses of $0.04 million and $0.07 million during the three and six months ended June 30, 2014, respectively, and $0.03 million and $0.06 million during the three and six months ended June 30, 2013, respectively, to general and administrative expense. Costs of future expenditures for obligations are discounted to their present value. The aggregate undiscounted obligation on all properties is $9.2 million and the discount rates used in the calculations range from 2.5% to 7.6%. We do not expect to make any payments in conjunction with these obligations in each of the next five years.

9

Comprehensive Loss

For the three and six months ended June 30, 2014 and 2013, comprehensive loss equaled net loss; therefore, a separate statement of comprehensive loss is not included in the accompanying condensed consolidated financial statements.

Recently Issued Accounting Guidance

The Financial Accounting Standards Board, or FASB, issued Accounting Standards Update No. 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” Under this revised guidance, only disposals representing a strategic shift in operations, such as a disposal of a major geographic area, a major line of business or a major equity method investment, will be presented as discontinued operations. This standard is effective for our fiscal year beginning January 1, 2015; however, the FASB has permitted early adoption beginning with the first quarter of 2014. We adopted this standard as of March 31, 2014. We anticipate the adoption will result in most disposals not qualifying for discontinued operations presentation.

In May 2014, the Financial Accounting Standards Board, or FASB, issued Accounting Standards, “Revenue from Contracts with Customers (ASC 606).” The revenue standard contains principles that an entity will apply to determine the measurement of revenue and timing of when it is recognized. This standard is effective for our fiscal year beginning January 1, 2017 and we are currently evaluating any impact from adoption.

2. Related-Party Transactions

Gladstone Management and Gladstone Administration

We are externally managed pursuant to contractual arrangements with our Adviser and our Administrator which collectively employ all of our personnel and pay their salaries, benefits, and general expenses directly. We have an advisory agreement with our Adviser, or the Advisory Agreement, and an administration agreement with our Administrator, or the Administration Agreement. The management and administrative services and fees under the Advisory and Administration Agreements are described below. At June 30, 2014 and December 31, 2013, $1.7 million and $1.4 million, respectively, was collectively due to our Adviser and Administrator.

Advisory Agreement

The Advisory Agreement provides for an annual base management fee equal to 2% of our total stockholders’ equity, less the recorded value of any preferred stock and adjusted to exclude the effect of any unrealized gains, losses or other items that do not affect realized net income (including impairment charges), or common stockholders’ equity, and an incentive fee based on funds from operations, or FFO. For the three and six months ended June 30, 2014, we recorded a base management fee of $0.7 million and $1.3 million, respectively, and for the three and six months ended June 30, 2013, we recorded a base management fee of $0.5 million and $0.8 million, respectively.

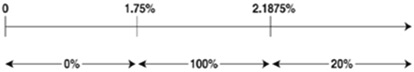

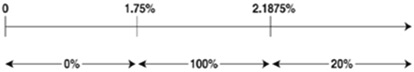

For purposes of calculating the incentive fee, FFO includes any realized capital gains and capital losses, less any distributions paid on preferred stock and senior common stock, but FFO does not include any unrealized capital gains or losses (including impairment charges). The incentive fee rewards the Adviser if our quarterly FFO, before giving effect to any incentive fee, or pre-incentive fee FFO, exceeds 1.75%, or 7% annualized, or the hurdle rate, of total common stockholders’ equity. The Adviser receives 100% of the amount of the pre-incentive fee FFO that exceeds the hurdle rate, but is less than 2.1875% of our common stockholders’ equity. The Adviser also receives an incentive fee of 20% of the amount of our pre-incentive fee FFO that exceeds 2.1875% of common stockholders’ equity.

For the three and six months ended June 30, 2014, we recorded an incentive fee of $1.5 million and $2.8 million, respectively, offset by credits related to unconditional, voluntary and irrevocable waivers issued by the Adviser of $1.0 million and $2.2 million, respectively, resulting in a net incentive fee for the three and six months ended June 30, 2014, of $0.5 million and $0.6 million, respectively. For the three and six

10

months ended June 30, 2013, we recorded an incentive fee of $0.9 million and $1.9 million, respectively, offset by credits related to unconditional, voluntary and irrevocable waivers issued by the Adviser of $0.9 million and $1.5 million, respectively, resulting in a net incentive fee for the three and six months ended June 30, 2013, of $0.0 million and $0.4 million, respectively. Our Board of Directors accepted the Adviser’s offer to waive, on a quarterly basis, a portion of the incentive fee for the three and six months ended June 30, 2014 and 2013, to support the current level of distributions to all classes of our stockholders. This waiver may not be recouped by the Adviser in the future.

Administration Agreement

Pursuant to the Administration Agreement, we pay for our allocable portion of the Administrator’s overhead expenses in performing its obligations to us, including, but not limited to, rent and the salaries and benefits of its personnel, including our chief financial officer and treasurer, chief compliance officer, general counsel and secretary, and their respective staffs. Our general counsel and secretary also serves as our Administrator’s president. Our allocable portion of expenses is derived by multiplying the Administrator’s total allocable expenses by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all companies managed by the Adviser under similar agreements. For the three and six months ended June 30, 2014, we recorded an administration fee of $0.5 million and $1.0 million, respectively, and for the three and six months ended June 30, 2013, we recorded an administration fee of $0.4 million and $0.7 million, respectively.

Gladstone Securities

Gladstone Securities, LLC, or Gladstone Securities, is a privately held broker dealer registered with The Financial Industry Regulatory Authority and insured by the Securities Investor Protection Corporation. Gladstone Securities is an affiliate of ours, as its parent company is controlled by Mr. David Gladstone, our chairman and chief executive officer. Mr. Gladstone also serves on the board of managers of Gladstone Securities.

Dealer Manager Agreement

In connection with the offering of our senior common stock (see Note 9, “Stockholders’ Equity,” for further details) we entered into a Dealer Manager Agreement, dated March 25, 2011, or the Dealer Manager Agreement, with Gladstone Securities pursuant to which Gladstone Securities agreed to act as our exclusive dealer manager in connection with the offering. Pursuant to the terms of the Dealer Manager Agreement, Gladstone Securities is entitled to receive a sales commission in the amount of 7.0% of the gross proceeds of the shares of senior common stock sold, plus a dealer manager fee in the amount of 3.0% of the gross proceeds of the shares of senior common stock sold. Gladstone Securities, in its sole and absolute discretion, may re-allocate all of its selling commissions attributable to a participating broker-dealer and may also re-allocate a portion of its dealer manager fee earned in respect of the proceeds generated by the participating broker-dealer to any participating broker-dealer as a non-accountable marketing allowance. In addition, we have agreed to indemnify Gladstone Securities against various liabilities, including certain liabilities arising under the federal securities laws. We made approximately $0.05 million and $0.1 million of payments during the three and six months ended June 30, 2014 respectively, and we made approximately $0.1 million and $0.2 million of payments during the three and six months ended June 30, 2013, respectively, to Gladstone Securities pursuant to this agreement, which are reflected as a component of senior common stock costs in the statement of stockholders’ equity. The Dealer Manager Agreement currently is scheduled to terminate on the earlier of (i) March 28, 2015 or (ii) the date on which 3,000,000 shares of senior common stock are sold pursuant to the Dealer Manager Agreement.

Mortgage Financing Arrangement Agreement

We also entered into an agreement with Gladstone Securities, effective June 18, 2013, for it to act as our non-exclusive agent to assist us with arranging mortgage financing for properties we own. In connection with this engagement, Gladstone Securities may from time to time solicit the interest of various commercial real estate lenders or recommend to us third party lenders offering credit products or packages that are

11

responsive to our needs. We pay Gladstone Securities a financing fee in connection with the services it provides to us for securing mortgage financing on any of our properties. The amount of these financing fees, which are payable upon closing of the financing, are based on a percentage of the amount of the mortgage, generally ranging from 0.5% to a maximum of 1.0% of the mortgage obtained. The amount of the financing fees may be reduced or eliminated, as determined by us and Gladstone Securities, after taking into consideration various factors, including, but not limited to, the involvement of any third party brokers and market conditions. We paid financing fees of $0.07 million during the three and six months ended June 30, 2014. We did not pay any financing fees during the three and six months ended June 30, 2013. The agreement, which was scheduled to terminate on August 31, 2014, was renewed for another year at the approval of our Board of Directors. It is now scheduled to terminate on August 31, 2015, unless renewed or earlier terminated.

3. Earnings (Loss) per Share of Common Stock

The following tables set forth the computation of basic and diluted earnings (loss) per share of common stock for the three and six months ended June 30, 2014 and 2013, respectively. We computed basic earnings (loss) per share for the three and six months ended June 30, 2014 and 2013, respectively, using the weighted average number of shares outstanding during the periods. Diluted earnings (loss) per share for the three and six months ended June 30, 2014 and 2013, reflects additional shares of common stock, related to our convertible senior common stock, that would have been outstanding if dilutive potential shares of common stock had been issued, as well as an adjustment to net income available to common stockholders as applicable to common stockholders that would result from their assumed issuance(dollars in thousands, except per share amounts).

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Calculation of basic earnings (loss) per share of common stock: |

||||||||||||||||

| Net earnings (loss) available (attributable) to common stockholders |

$ | 86 | $ | (641 | ) | $ | (14,554 | ) | $ | (1,286 | ) | |||||

| Denominator for basic weighted average shares of common stock |

16,547,793 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic earnings (loss) per share of common stock |

$ | 0.01 | $ | (0.05 | ) | $ | (0.90 | ) | $ | (0.11 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Calculation of diluted earnings (loss) per share of common stock: |

||||||||||||||||

| Net income (loss) available (attributable) to common stockholders |

$ | 86 | $ | (641 | ) | $ | (14,554 | ) | $ | (1,286 | ) | |||||

| Add: Income impact of assumed conversion of senior common stock (1) |

110 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) available (attributable) to common stockholders plus assumed conversions |

$ | 196 | $ | (641 | ) | $ | (14,554 | ) | $ | (1,286 | ) | |||||

| Denominator for basic weighted average shares of common stock |

16,547,793 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

| Effect of convertible senior common stock (1) |

347,180 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator for diluted weighted average shares of common stock |

16,894,973 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted earnings (loss) per share of common stock |

$ | 0.01 | $ | (0.05 | ) | $ | (0.90 | ) | $ | (0.11 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | We excluded convertible senior common shares of 332,608 from the calculation of diluted earnings per share for the six months ended June 30, 2014 because it was anti-dilutive. We also excluded 195,759, and 180,753, from the calculation of diluted earnings per share for the three and six months ended June 30, 2013, respectively, because it was anti-dilutive. |

4. Real Estate and Intangible Assets

Real Estate

The following table sets forth the components of our investments in real estate as of June 30, 2014 and December 31, 2013 (dollars in thousands):

| June 30, 2014 | December 31, 2013 | |||||||

| Real estate: |

||||||||

| Land |

$ | 83,352 | $ | 79,153 | ||||

| Building and improvements |

561,138 | 527,230 | ||||||

| Tenant improvements |

39,511 | 35,970 | ||||||

| Accumulated depreciation |

(88,520 | ) | (81,241 | ) | ||||

|

|

|

|

|

|||||

| Real estate, net |

$ | 595,481 | $ | 561,112 | ||||

|

|

|

|

|

|||||

12

2014 Real Estate Activity

During the six months ended June 30, 2014, we acquired six properties, which are summarized in the table below (dollars in thousands):

| Location |

Acquisition Date | Square Footage | Lease Term |

Renewal Options |

Total Purchase Price |

Acquisition Expenses |

Annualized Straight Line Rent |

Debt Issued & Assumed |

||||||||||||||||||||

| Allen, TX |

3/27/2014 | 21,154 | 12 Years | 4 (5 years each) | $ | 5,525 | $ | 29 | $ | 570 | $ | 3,481 | ||||||||||||||||

| Colleyville, TX |

3/27/2014 | 20,355 | 12 Years | 4 (5 years each) | 4,523 | 29 | 467 | 2,849 | ||||||||||||||||||||

| Rancho Cordova, CA |

4/22/2014 | 61,358 | 10 Years | 1 (5 year) | 8,225 | 65 | 902 | 4,935 | ||||||||||||||||||||

| Coppell, TX |

5/8/2014 | 21,171 | 12 Years | 4 (5 years each) | 5,838 | 22 | 601 | 3,816 | ||||||||||||||||||||

| Columbus, OH |

5/13/2014 | 114,786 | 9.5 Years | N/A | 11,800 | 65 | 1,278 | N/A | ||||||||||||||||||||

| Taylor, PA |

6/9/2014 | 955,935 | 10 Years | 4 (5 years each) | 39,000 | 714 | 3,400 | 22,600 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

1,194,759 | $ | 74,911 | $ | 924 | $ | 7,218 | $ | 37,681 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

In accordance with ASC 805, we determined the fair value of the acquired assets related to the six properties acquired during the six months ended June 30, 2014 as follows (in thousands):

| Land | Building | Tenant Improvements |

In-place Leases |

Leasing Costs |

Customer Relationships |

Above Market Leases |

Below Market Leases |

Premium on Assumed Debt |

Total Purchase Price |

|||||||||||||||||||||||||||||||

| Allen, TX |

$ | 874 | $ | 3,509 | $ | 125 | $ | 598 | $ | 273 | $ | 218 | $ | — | $ | — | $ | (72 | ) | $ | 5,525 | |||||||||||||||||||

| Colleyville, TX |

1,277 | 2,307 | 117 | 486 | 220 | 181 | — | (6 | ) | (59 | ) | 4,523 | ||||||||||||||||||||||||||||

| Rancho Cordova, CA |

752 | 5,898 | 278 | 473 | 546 | 278 | — | — | — | 8,225 | ||||||||||||||||||||||||||||||

| Coppell, TX |

1,448 | 3,221 | 128 | 636 | 293 | 230 | — | — | (118 | ) | 5,838 | |||||||||||||||||||||||||||||

| Columbus, OH |

990 | 6,080 | 1,937 | 823 | 719 | 990 | 261 | — | — | 11,800 | ||||||||||||||||||||||||||||||

| Taylor, PA |

3,102 | 24,449 | 956 | 6,171 | 1,452 | 2,870 | — | — | — | 39,000 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| $ | 8,443 | $ | 45,464 | $ | 3,541 | $ | 9,187 | $ | 3,503 | $ | 4,767 | $ | 261 | $ | (6 | ) | $ | (249 | ) | $ | 74,911 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Below is a summary of the total revenue and earnings recognized on the six properties acquired during the three and six months ended June 30, 2014 (dollars in thousands):

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||||||

| 2014 | 2014 | |||||||||||||||||||

| Location |

Acquisition Date |

Rental Revenue | Earnings (1) | Rental Revenue | Earnings (1) | |||||||||||||||

| Allen, TX |

3/27/2014 | $ | 142 | $ | 81 | $ | 150 | $ | 86 | |||||||||||

| Colleyville, TX |

3/27/2014 | 117 | 67 | 123 | 71 | |||||||||||||||

| Rancho Cordova, CA |

4/22/2014 | 173 | 65 | 173 | 65 | |||||||||||||||

| Coppell, TX |

5/8/2014 | 89 | 52 | 89 | 52 | |||||||||||||||

| Columbus, OH |

5/13/2014 | 167 | 68 | 167 | 68 | |||||||||||||||

| Taylor, PA |

6/9/2014 | 208 | 98 | 208 | 98 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 896 | $ | 431 | $ | 910 | $ | 440 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Earnings is calculated as net income exclusive of both interest expense and acquisition related costs that are required to be expensed under ASC 805. |

13

Pro Forma

The following table reflects pro-forma consolidated statements of operations as if the six properties acquired during the three and six months ended June 30, 2014 were acquired as of the beginning of the previous period. The pro-forma earnings for the three and six months ended June 30, 2014 and 2013 were adjusted to assume that acquisition-related costs were incurred as of the beginning of the previous period (dollars in thousands, except per share amounts):

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Operating Data: |

||||||||||||||||

| Total operating revenue |

$ | 19,339 | $ | 18,822 | $ | 38,316 | $ | 37,628 | ||||||||

| Total operating expenses |

(10,986 | ) | (11,090 | ) | (35,799 | )(1) | (21,608 | ) | ||||||||

| Other expenses |

(6,202 | ) | (7,566 | ) | (13,655 | ) | (15,355 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

2,151 | 166 | (11,138 | ) | 665 | |||||||||||

| Dividends attributable to preferred and senior common stock |

(1,133 | ) | (1,092 | ) | (2,257 | ) | (2,169 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) available (attributable) to common stockholders |

$ | 1,018 | $ | (926 | ) | $ | (13,395 | ) | $ | (1,504 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Share and Per Share Data: |

||||||||||||||||

| Basic and diluted earnings (loss) per share of common stock |

$ | 0.06 | $ | (0.07 | ) | $ | (0.83 | ) | $ | (0.13 | ) | |||||

| Weighted average shares outstanding-basic |

16,547,793 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

| Weighted average shares outstanding-diluted |

16,894,973 | 12,380,402 | 16,149,467 | 11,808,701 | ||||||||||||

| (1) | $14.0 million relates to the impairment charge recorded in operating expenses during the three months ended March 31, 2014. |

2013 Real Estate Activity

During the six months ended June 30, 2013, we acquired three properties and completed an expansion of one property, which are summarized below (dollars in thousands):

| Location |

Acquisition/ Expansion Date |

Square Footage | Lease |

Renewal Options |

Total Purchase/ Expansion Price |

Acquistion Expenses |

Annualized Straight Line Rent |

Debt Issued |

||||||||||||||||||||

| Egg Harbor Township, NJ |

3/28/2013 | 29,257 | 10 years | 1 (5 years) | $ | 5,650 | $ | 152 | $ | 490 | $ | 3,700 | ||||||||||||||||

| Clintonville, WI (1) |

4/11/2013 | 102,400 | 15 years | N/A | 3,250 | N/A | 961 | — | ||||||||||||||||||||

| Vance, AL |

5/8/2013 | 170,000 | 10 years | 2 (5 year options) | 13,388 | 186 | 1,173 | — | ||||||||||||||||||||

| Blaine, MN |

5/10/2013 | 92,275 | 6.9 years | 2 (5 year options) | 14,450 | 79 | 1,475 | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

393,932 | $ | 36,738 | $ | 417 | $ | 4,099 | $ | 3,700 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (1) | The Clintonville, WI property was originally acquired in November 2005 for $5.3 million. After the expansion completed in April 2013, the total investment in the property is $8.6 million. |

In accordance with ASC 805, we determined the fair value of acquired assets related to the three properties acquired during the six months ended June 30, 2013 as follows (in thousands):

| Land | Building | Tenant Improvements |

In-place Leases |

Leasing Costs | Customer Relationships |

Total Purchase Price |

||||||||||||||||||||||

| Egg Harbor Township, NJ |

$ | 1,627 | $ | 2,735 | $ | 282 | $ | 558 | $ | 189 | $ | 259 | $ | 5,650 | ||||||||||||||

| Vance, AL |

457 | 9,721 | 808 | 1,097 | 678 | 627 | 13,388 | |||||||||||||||||||||

| Blaine, MN |

1,060 | 9,347 | 1,172 | 1,361 | 694 | 816 | 14,450 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| $ | 3,144 | $ | 21,803 | $ | 2,262 | $ | 3,016 | $ | 1,561 | $ | 1,702 | $ | 33,488 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Below is a summary of the total revenue and earnings recognized on the three properties acquired during the six months ended June 30, 2013 (dollars in thousands):

| Location |

Acquisition Date |

For the three months ended June 30, 2013 | For the six months ended June 30, 2013 | |||||||||||||||||

| Rental Revenue | Earnings (1) | Rental Revenue | Earnings (1) | |||||||||||||||||

| Egg Harbor Township, NJ |

3/28/2013 | $ | 122 | $ | 69 | $ | 128 | $ | 72 | |||||||||||

| Vance, AL |

5/8/2013 | 170 | 70 | 170 | 70 | |||||||||||||||

| Blaine, MN |

5/10/2013 | 210 | 94 | 210 | 94 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 502 | $ | 233 | $ | 508 | $ | 236 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Earnings is calculated as net income less interest expense and acquisition related costs that are required to be expensed under ASC 805. |

14

Future Lease Payments

Future operating lease payments from tenants under non-cancelable leases, excluding tenant reimbursement of expenses, for the remainder of 2014 and each of the five succeeding fiscal years and thereafter is as follows (dollars in thousands):

| Year |

Tenant Lease Payments |

|||

| Six Months ending December 31, 2014 |

$ | 34,255 | ||

| 2015 |

65,830 | |||

| 2016 |

63,228 | |||

| 2017 |

62,763 | |||

| 2018 |

61,125 | |||

| 2019 |

61,469 | |||

| Thereafter |

274,216 | |||

Significant Existing Real Estate Activity

On April 4, 2014, our tenant occupying our Newburyport, Massachusetts property notified us of their intention not to exercise their renewal option as the tenant is relocating to Rhode Island. The tenant will continue paying rent and operating expenses through the lease termination date of April 30, 2015.

On May 6, 2014, we extended the lease with the tenant occupying our property located in Austin, Texas. The lease covering this property was extended for an additional eight years, through June 2022. The lease was originally set to expire in June 2015. The lease provides for prescribed rent escalations over the life of the lease, with annualized straight line rents of approximately $0.7 million. In connection with the extension of the lease and modification of certain terms of the lease, we paid $0.2 million in leasing commissions, and will pay $1.3 million in tenant improvements between now and second quarter 2015.

On June 11, 2014, we extended the lease with the tenant occupying our property located in Burnsville, Minnesota. The new lease covers approximately two-thirds of the space and was extended for an additional eight years, through January 2023. The lease was originally set to expire in June 2015. The tenant in this property will continue to pay rent on the entire building through June 2015, and we are working to identify tenants to lease the remainder of the building. The new lease provides for prescribed rent escalations over the life of the lease, with annualized straight line rents of $1.0 million. Rental income per square foot increased 14% from the previous lease. The lease grants the tenant two options to extend the lease for an additional 3 years each. In connection with the extension of the lease and the modification of certain terms under the lease, we paid $0.5 million in leasing commissions, and will pay $3.3 million in tenant improvements between now and first quarter 2015.

Intangible Assets

The following table summarizes the carrying value of intangible assets and the accumulated amortization for each intangible asset class (dollars in thousands):

| June 30, 2014 | December 31, 2013 | |||||||||||||||

| Lease Intangibles |

Accumulated Amortization |

Lease Intangibles |

Accumulated Amortization |

|||||||||||||

| In-place leases |

$ | 56,521 | $ | (17,205 | ) | $ | 47,442 | $ | (15,158 | ) | ||||||

| Leasing costs |

35,251 | (10,680 | ) | 31,339 | (9,323 | ) | ||||||||||

| Customer relationships |

39,896 | (11,654 | ) | 35,739 | (10,407 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 131,668 | $ | (39,539 | ) | $ | 114,520 | $ | (34,888 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

15

The weighted average amortization periods in years for the intangible assets acquired and liabilities assumed during the six months ended June 30, 2014 and 2013, respectively, were as follows

| Intangible Assets & Liabilities |

2014 | 2013 | ||||||

| In-place leases |

10.7 | 9.3 | ||||||

| Leasing costs |

10.7 | 9.3 | ||||||

| Customer relationships |

15.6 | 14.2 | ||||||

| Above market leases |

8.2 | — | ||||||

| Below market leases |

11.9 | — | ||||||

|

|

|

|

|

|||||

| All intangible assets & liabilities |

12.2 | 10.9 | ||||||

|

|

|

|

|

|||||

The estimated aggregate amortization expense for the remainder of 2014 and for each of the five succeeding fiscal years and thereafter is as follows (dollars in thousands):

| Year |

Estimated Amortization Expense |

|||

| Six Months ending December 31, 2014 |

$ | 5,834 | ||

| 2015 |

11,395 | |||

| 2016 |

10,732 | |||

| 2017 |

10,539 | |||

| 2018 |

10,251 | |||

| 2019 |

10,243 | |||

| Thereafter |

33,135 | |||

5. Real Estate Held for Sale and Impairment Charges

Real Estate Held for Sale

As of March 31, 2014, we classified our property located in Sterling Heights, Michigan as held for sale under the provisions of ASC 360-10, which requires that the assets and liabilities of any properties which are held for sale, be presented separately in our condensed consolidated balance sheet in the current period presented. On June 6, 2014, we sold the property to the tenant currently occupying the building for $11.4 million and recognized a gain of $1.2 million on the sale.

The table below summarizes the components of income from real estate and related assets held for sale for the three and six months ended June 30, 2014 and June 30, 2013, respectively:

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Operating revenue |

$ | 215 | $ | 292 | $ | 507 | $ | 583 | ||||||||

| Operating expense |

1 | 57 | 40 | 114 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from real estate and related assets held for sale |

$ | 214 | $ | 235 | $ | 467 | $ | 469 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Impairment Charges

We performed the evaluation and analysis of our portfolio and concluded that our Roseville, Minnesota property was impaired as of March 31, 2014. We determined that the expected undiscounted cash flows based upon a revised estimated holding period of this property was below the current carrying value. The estimated holding period was revised after a potential tenant that we were anticipating to lease a large

16

portion of the vacant space, during the three months ended March 31, 2014, did not execute a lease on the property. Consequently, we revised the holding period to coincide with the maturity of the mortgage loan in June 2014. Accordingly, we reduced the carrying value of this property to its estimated fair value, less cost to sell, and we recognized an impairment loss of $14.0 million during the three months ended March 31, 2014.

We also determined our property located in South Hadley, Massachusetts is at risk to become impaired in the future. We recently extended the lease on the property for one year, and it now expires in January 2015. There is a possibility we may have to impair this 150,000 square foot industrial property in 2014 if we do not negotiate another lease extension on this building or find a replacement tenant.

We will continue to monitor our portfolio for any other indicators of impairment.

6. Mortgage Notes Payable and Line of Credit

Our mortgage notes payable and line of credit as of June 30, 2014 and December 31, 2013 are summarized below (dollars in thousands):

| Carrying Value at | ||||||||||||||||

| Encumbered properties at June 30, 2014 |

June 30, 2014 | December 31, 2013 | Stated Interest Rates at June 30, 2014 (4) |

Scheduled Maturity Dates at June 30, 2014 | ||||||||||||

| Mortgage and Other Secured Loans: |

||||||||||||||||

| Fixed rate mortgage loans |

71 | $ | 447,178 | $ | 413,678 | (1) | (2) | |||||||||

| Variable rate mortgage loans |

4 | 8,200 | 8,200 | LIBOR+2.15% (3) | 12/1/2016 | |||||||||||

| Premiums and discounts (net) |

N/A | 859 | 724 | N/A | N/A | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Mortgage Notes Payable |

75 | $ | 456,237 | $ | 422,602 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Variable rate Line of Credit |

16 | 25,650 | 24,400 | LIBOR+3.00% (3) | 8/1/2017 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Mortgage Notes Payable and Line of Credit |

91 | $ | 481,887 | $ | 447,002 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | Interest rates on our fixed rate mortgage notes payable vary from 4.04% to 6.80%. |

| (2) | We have 40 mortgage notes payable with maturity dates ranging from 9/1/2015 through 1/06/2039. |

| (3) | At June 30, 2014, one month LIBOR was approximately 0.1552%. |

| (4) | The weighted average interest rate on all debt outstanding at June 30, 2014, was approximately 5.25%. |

N/A - Not Applicable

Mortgage Notes Payable

As of June 30, 2014, we had 40 mortgage notes payable, which were collateralized by a total of 75 properties with a net book value of $607.8 million. Gladstone Commercial Corporation has limited recourse liabilities that could result from any one or more of the following circumstances: a borrower voluntarily filing for bankruptcy, improper conveyance of a property, fraud or material misrepresentation, misapplication or misappropriation of rents, security deposits, insurance proceeds or condemnation proceeds, or physical waste or damage to the property resulting from a borrower’s gross negligence or willful misconduct. We will also indemnify lenders against claims resulting from the presence of hazardous substances or activity involving hazardous substances in violation of environmental laws on a property. The weighted-average interest rate on the mortgage notes payable as of June 30, 2014 was 5.36%.

17

During the six months ended June 30, 2014, we assumed two long-term mortgages, collateralized by three properties, and issued two long-term mortgages, collateralized by two properties, which are summarized below (dollars in thousands):

| Date of Issuance |

Issuing Bank |

Debt Issued | Interest Rate | Maturity Date | ||||||||

| 3/27/2014 |

Wells Fargo N.A. | $ | 6,330 | 5.58 | % | 2/1/2016 | ||||||

| 4/22/2014 |

Keybank N.A. | 4,935 | 4.90 | % | 5/1/2024 | |||||||

| 5/8/2014 |

Wells Fargo N.A. | 3,816 | 6.25 | % | 6/1/2016 | |||||||

| 6/9/2014 |

Prudential Mortgage Capital Company | 22,600 | 4.23 | % | 7/1/2019 | |||||||

|

|

|

|||||||||||

| $ | 37,681 | |||||||||||

|

|

|

|||||||||||

Scheduled principal payments of mortgage notes payable for the remainder of 2014, and each of the five succeeding fiscal years and thereafter are as follows (dollars in thousands):

| Year |

Scheduled Principal Payments |

|||

| Six Months ending December 31, 2014 |

$ | 20,798 | ||

| 2015 |

42,683 | |||

| 2016 |

98,702 | |||

| 2017 |

67,201 | |||

| 2018 |

19,789 | |||

| 2019 |

34,449 | |||

| Thereafter |

171,756 | |||

|

|

|

|||

| $ | 455,378 | |||

|

|

|

|||

Interest Rate Cap

In November 2013, we entered into an interest rate cap agreement with Wells Fargo that caps the interest rate on the note payable for our Champaign, Illinois property. The agreement provides that the interest rate on the note payable for this property is capped at a certain interest rate when one-month LIBOR is in excess of 3.0%. The fair value of the interest rate cap agreement is recorded in other assets on our accompanying condensed consolidated balance sheets. We record changes in the fair value of the interest rate cap agreement quarterly based on the current market valuations at quarter end as other income (loss) on our accompanying condensed consolidated statements of operations. Generally, we will estimate the fair value of our interest rate cap using estimates of value provided by the counterparty and our own assumptions in the absence of observable market data, including estimated remaining life, counterparty credit risk, current market yield and interest rate spreads of similar securities as of the measurement date. At June 30, 2014, our interest rate cap agreement was valued using Level 3 inputs of the hierarchy established by ASC 820, “Fair Value Measurements and Disclosures.” The following table summarizes the key terms of each interest rate cap agreement (dollars in thousands):

| As of June 30, 2014 |

||||||||||||||||||||||||

| Interest Rate Cap |

Notional Amount |

LIBOR Cap | Effective Date | Maturity Date | Cost | Fair Value | ||||||||||||||||||

| November 26, 2013 |

$ | 8,200 | 3.00 | % | June 30, 2014 | December 1, 2016 | $ | 31 | $ | 7 | ||||||||||||||

18

Fair Value

The fair value of all mortgage notes payable outstanding as of June 30, 2014, was $462.1 million, as compared to the carrying value stated above of $456.2 million. The fair value is calculated based on a discounted cash flow analysis, using interest rates based on management’s estimate of market interest rates on long-term debt with comparable terms and loan to value ratios. The fair value was calculated using Level 3 inputs of the hierarchy established by ASC 820, “Fair Value Measurements and Disclosures.”

Line of Credit

In August 2013, we procured a $60.0 million senior unsecured revolving credit facility, or the Line of Credit, with KeyBank National Association (serving as a revolving lender, a letter of credit issuer and administrative agent) and Citizens Bank of Pennsylvania as an additional lender. On December 16, 2013, Comerica Bank was also added as an additional lender. On March 28, 2014, we amended our Line of Credit to extend the maturity date one additional year to August 2017. We also modified certain terms under the Line of Credit, including the calculation of the total asset value and unencumbered asset value. The applicable LIBOR margins were also reduced by 25 basis points at each pricing level. As a result of these modifications, the availability under our line of credit increased by $1.3 million.

The Line of Credit initially matures in August 2017; however, we have a one-year extension option subject to the payment of an extension fee equal to 25 basis points on the initial maturity date and certain other customary conditions.

The Line of Credit has a letter of credit sublimit of up to $20.0 million. In addition, we may expand the Line of Credit up to a total of $75.0 million upon satisfaction of certain conditions, including obtaining commitments from any one or more lenders, whether or not currently a party to the Line of Credit, to provide such increased amounts and payment of the associated up front and arrangement fees at the time of such increase. The interest rate per annum applicable to the Line of Credit is equal to the LIBOR plus an applicable margin of up to 3.0%, depending upon our leverage. The leverage ratio used in determining the applicable margin for interest on the Line of Credit is recalculated quarterly. We are subject to an annual maintenance fee of $0.03 million per year and an unused commitment fee of 25 basis points per year, which accrues quarterly. Our ability to access this source of financing is subject to our continued ability to meet customary lending requirements, such as compliance with financial and operating covenants and our meeting certain lending limits. One such covenant requires us to limit distributions to our stockholders to 100% of our FFO, with acquisition-related costs required to be expensed under ASC 805 added back to FFO. In addition, the maximum amount we may draw under the Line of Credit is based on a percentage of the value of a pool of unencumbered properties which must meet agreed upon eligibility standards.

If and when long-term mortgages are arranged for properties in the unencumbered pool, the banks will reduce the availability under the Line of Credit by the amount advanced against that property’s value. Conversely, as we purchase new properties meeting the eligibility standards, we may add these new properties to the unencumbered pool to obtain additional availability under the Line of Credit. The availability under the Line of Credit is also reduced by letters of credit used in the ordinary course of business. We may use the advances under the Line of Credit for both general corporate purposes and the acquisition of new investments.

As of June 30, 2014, there was $25.7 million outstanding under our Line of Credit at an interest rate of approximately 3.2% and $6.8 million outstanding under letters of credit at a weighted average interest rate of 3.0%. As of June 30, 2014, the maximum additional amount we could draw was $19.7 million. We were in compliance with all covenants under the Line of Credit as of June 30, 2014. The amount outstanding on the Line of Credit as of June 30, 2014 approximates fair value, because the debt is subject to a variable interest rate, determined by market forces, as well as a recently negotiated interest rate spread.

7. Mandatorily Redeemable Preferred Stock

In February 2012, we completed a public offering of 1,540,000 shares of 7.125% Series C Cumulative Term Preferred Stock, par value $0.001 per share, or the Term Preferred Stock, at a public offering price of $25.00 per share. Gross proceeds of the offering totaled $38.5 million and net proceeds, after deducting offering expenses borne by us, were $36.7 million and were used to repay a portion of outstanding

19

borrowings under our Line of Credit, for acquisitions of real estate and for working capital. The Term Preferred Stock is traded under the ticker symbol GOODN on the NASDAQ Global Select Market, or the NASDAQ. The Term Preferred Stock is not convertible into our common stock or any other security of ours. Generally, we may not redeem shares of the Term Preferred Stock prior to January 31, 2016, except in limited circumstances to preserve our status as a REIT. On or after January 31, 2016, we may redeem the shares at a redemption price of $25.00 per share, plus any accumulated and unpaid dividends to and including the date of redemption. The shares of the Term Preferred Stock have a mandatory redemption date of January 31, 2017. We incurred $1.8 million in total offering costs related to these transactions, which have been recorded as deferred financing costs on the condensed consolidated balance sheet and will be amortized over the redemption period ending January 31, 2017.

The Term Preferred Stock is recorded as liability in accordance with ASC 480, “Distinguishing Liabilities from Equity,” which states that mandatorily redeemable financial instruments should be classified as liabilities and therefore the related dividend payments are treated as a component of interest expense in the condensed consolidated statements of operations.