UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33097

GLADSTONE COMMERCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| Maryland | 02-0681276 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1521 Westbranch Drive, Suite 100 McLean, Virginia |

22102 | |

| (Address of principal executive offices) | (Zip Code) | |

(703) 287-5800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each Class) |

(Name of each exchange on which registered) | |

| Common Stock, $0.001 par value per share | NASDAQ Global Select Market | |

| 7.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share | NASDAQ Global Select Market | |

| 7.50% Series B Cumulative Redeemable Preferred Stock, par value $0.001 per share | NASDAQ Global Select Market | |

| 7.125% Series C Cumulative Term Preferred Stock, par value $0.001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12 b-2 of the Act). YES ¨ NO x.

The aggregate market value of the voting common stock held by non-affiliates of the Registrant on June 30, 2014, based on the closing price on that date of $17.87 on the NASDAQ Global Select Market, was $307,467,128. For the purposes of calculating this amount only, all directors and executive officers of the Registrant have been treated as affiliates. There were 20,359,081 shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of February 18, 2015.

Documents Incorporated by Reference: Portions of the Registrant’s Proxy Statement, to be filed no later than April 30, 2015, relating to the Registrant’s 2015 Annual Meeting of Stockholders, are incorporated by reference into Part III of this Annual Report on Form 10-K.

GLADSTONE COMMERCIAL CORPORATION

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2014

2

Forward-Looking Statements

Our disclosure and analysis in this Annual Report on Form 10-K, or Form 10-K, and the documents that are incorporated by reference herein, contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Ligation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends concerning matters that are not historical facts. These forward-looking statements include information about possible or assumed future events, including, among other things, discussion and analysis of our future financial condition, results of operations and funds from operations, or FFO, our strategic plans and objectives, cost management, occupancy and leasing rates and trends, liquidity and ability to refinance our indebtedness as it matures, anticipated capital expenditures (and access to capital) required to complete projects, amounts of anticipated cash distributions to our stockholders in the future and other matters. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may” and variations of these words and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements contain these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Statements regarding the following subjects, among others, are forward-looking by their nature:

| • | re-leasing efforts; |

| • | our business and financing strategy; |

| • | our ability to implement our business plan; |

| • | pending transactions; |

| • | our projected operating results; |

| • | our ability to obtain future financing arrangements; |

| • | estimates relating to our future distributions; |

| • | our understanding of our competition and our ability to compete effectively; |

| • | market and industry trends; |

| • | interest and insurance rates; |

| • | estimates of our future operating expenses, including payments to our Adviser (as defined herein) under the terms of our Advisory Agreement (as defined herein); |

| • | projected capital expenditures; and |

| • | use of the proceeds of our Line of Credit (as defined herein), mortgage notes payable, future stock offerings and other future capital resources, if any. |

Forward-looking statements involve inherent uncertainty and may ultimately prove to be incorrect or false. You are cautioned not to place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to:

| • | general volatility of the capital markets and the market price of our common and preferred stock; |

3

| • | failure to qualify as a real estate investment trust, or REIT, and in the risk of changing laws that affect REITs; |

| • | risks associated with negotiation and consummation of pending and future transactions; |

| • | changes in our business strategy; |

| • | the adequacy of our cash reserves and working capital; |

| • | our failure to successfully integrate and operate acquired properties and operations; |

| • | defaults upon or non-renewal of leases by tenants; |

| • | decreased rental rates or increased vacancy rates; |

| • | the degree and nature of our competition, including other real estate investment companies; |

| • | availability, terms and deployment of capital, including the ability to maintain and borrow under our Line of Credit, arrange for long-term mortgages on our properties, secure additional long-term lines of credit and raise equity capital; |

| • | our Adviser’s ability to identify, hire and retain highly-qualified personnel; |

| • | changes in our industry or the general economy; |

| • | changes in real estate and zoning laws and increases in real property tax rates; |

| • | changes in governmental regulations, tax rates and similar matters; |

| • | environmental uncertainties and risks related to natural disasters; and |

| • | the loss of any of our key officers, such as Mr. David Gladstone, our chairman and chief executive officer, Mr. Terry Lee Brubaker, our vice chairman and chief operating officer, or Mr. Robert Cutlip, our president. |

This list of risks and uncertainties, however, is only a summary of some of the most important factors to us and is not intended to be exhaustive. You should carefully review the risks set forth herein under the caption “Item 1A. Risk Factors.” New factors may also emerge from time to time that could have a material adverse affect on our business.

| Item 1. | Business. |

Overview

Gladstone Commercial Corporation (which we refer to as “we,” “us,” or the “Company”) is a REIT that was incorporated under the General Corporation Laws of the State of Maryland on February 14, 2003, primarily for the purpose of investing in and owning net leased industrial, commercial and retail real

4

property and selectively making long-term industrial and commercial mortgage loans. Our portfolio of real estate is leased to a wide cross section of tenants ranging from small businesses to large public companies, many of which are corporations that do not have publicly rated debt. As we have in the past, we intend to enter into, purchase agreements for real estate having triple net leases with terms of approximately 10 to 15 years and built-in rental increases. Under a triple net lease, the tenant is required to pay all operating, maintenance and insurance costs and real estate taxes with respect to the leased property. As of February 18, 2015, we owned a total of 96 properties.

We conduct substantially all of our activities, including the ownership of all of our properties, through Gladstone Commercial Limited Partnership, a Delaware limited partnership, which we refer to as our Operating Partnership. We control our Operating Partnership through our ownership of GCLP Business Trust II, a Massachusetts business trust, which is the general partner of our Operating Partnership, and of GCLP Business Trust I, a Massachusetts business trust, which currently holds all of the limited partnership units of our Operating Partnership. Our Operating Partnership may issue limited partnership units from time to time in exchange for industrial and commercial real property. Limited partners who hold limited partnership units in our Operating Partnership will generally be entitled to redeem these units for cash or, at our election, shares of our common stock on a one-for-one basis.

Our Operating Partnership is also the sole member of Gladstone Commercial Lending, LLC, which we refer to as Gladstone Commercial Lending. Gladstone Commercial Lending is a Delaware limited liability company that was formed to hold any real estate mortgage loans.

Our business is managed by our external adviser, Gladstone Management Corporation, or our Adviser. Gladstone Administration, LLC, or our Administrator, provides administrative services to us. Both our Advisor and our Administrator are affiliates of ours and each other.

Our Investment Objectives and Our Strategy

Our principal investment objectives are to generate income from rental properties and, to a much lesser extent, mortgage loans, which we use to fund our continuing operations and to pay monthly cash distributions to our stockholders. Our primary strategy to achieve our investment objectives is to invest in and own a diversified portfolio of leased industrial, commercial and retail real estate that we believe will produce stable cash flow and increase in value. We may sell some of our real estate assets when our Adviser determines that doing so would be advantageous to us and our stockholders. We also expect to occasionally make mortgage loans secured by income-producing commercial, industrial or retail real estate, which loans may have some form of equity participation. We currently have one mortgage loan outstanding.

We use leverage to maximize potential returns to stockholders. We are not limited with respect to the amount of leverage that we may use for the acquisition of any specific property, although we have certain portfolio-level leverage covenants we must comply with under the terms of our unsecured line of credit, or the Line of Credit. We intend to use non-recourse mortgage financing that will allow us to limit our loss exposure on any property to the amount of equity invested in such property. The market for long-term mortgages continues to improve as they become more obtainable and the environment is competitive. The collateralized mortgage backed securities, or CMBS, market remains active but it is more conservative and restrictive than it was prior to the recent recession and uncertainty with regard to interest rates has made the CMBS market less predictable. Consequently, we continue to look to regional banks, insurance companies and other non-bank lenders, in addition to the CMBS market, to issue mortgages to finance our real estate activities.

In addition to leverage, we were active in the equity markets during 2014 by issuing shares of common stock in one follow-on public offering, issuing shares under our at-the-market programs, or ATM Programs, pursuant to our former open market sale agreement with Jefferies, LLC, or Jefferies, and our current agreement with Cantor Fitzgerald & Co., or Cantor Fitzgerald, and also issuing shares of our convertible senior common stock.

5

Investment Policies

Types of Investments

Overview

We intend that substantially all of our investments will be generated from the ownership of income-producing real property or, to a much lesser extent, mortgage loans secured by real property. We expect that a majority of our investments will be continue to be structured as net leases, but if a net lease would have an adverse impact on a potential tenant, or we assume a lease with a different existing structure in place, we may structure our investment as either a gross, or modified gross lease or as a mortgage loan. Investments are not restricted to geographical areas, but we expect that most of our investments in real estate will continue to be made within the continental United States. Some of our investments may also be made through joint ventures that would permit us to own interests in large properties without restricting the diversity of our portfolio. Our stockholders are not afforded the opportunity to evaluate the economic merits of our investments or the terms of any dispositions of properties and instead rely on the advice of our Adviser. See “Risk Factors—Our success depends on the performance of our Adviser and if our Adviser makes inadvisable investment or management decisions, our operations could be materially adversely impacted.”

We anticipate that we will make substantially all of our investments through our Operating Partnership and Gladstone Commercial Lending. Our Operating Partnership and Gladstone Commercial Lending may acquire interests in real property or mortgage loans in exchange for the issuance of limited partnership units, for cash or through a combination of both. Units issued by our Operating Partnership generally will be redeemable for cash or, at our election, shares of our common stock on a one-for-one basis. However, we may in the future also conduct some of our business and hold some of our interests in real properties or mortgage loans through one or more wholly-owned subsidiaries that are not owned, directly or indirectly, through our Operating Partnership or Gladstone Commercial Lending. We have not issued any limited partnership units to date.

Property Acquisitions and Net Leasing

To date, we have purchased a majority of our properties from owners that have leased their properties to non-affiliated tenants, and while we have engaged in some transactions with tenants who have consummated sale-leaseback transactions, these transactions do not comprise the dominant portion of our portfolio. We expect that some of our sale-leaseback transactions will be in conjunction with acquisitions, recapitalizations or other corporate transactions affecting our tenants. In these transactions, we may act as one of several sources of financing by purchasing one or more properties from the tenant and by leasing it on a net basis to the tenant or its successor in interest. For a discussion of the risks associated with leasing property to leveraged tenants, see “Risk Factors—Highly leveraged tenants and borrowers may be unable to pay rent or make mortgage payments, which could adversely affect our cash available to make distributions to our stockholders.”

In limited circumstances, we have granted tenants an option to purchase the leased property, and we anticipate granting these options to select tenants in the future. In these cases, we generally seek to fix the option purchase price at the greater of our purchase price for the property and the fair market value of the property at the time the option is exercised.

Our portfolio consists primarily of single-tenant commercial and industrial real property; however, we continue to acquire multi-tenant commercial and industrial properties, as well as retail and medical properties. Generally, we lease properties to tenants that our Adviser deems creditworthy under leases that will be full recourse obligations of our tenants or their affiliates. In most cases, our leases will be “triple net leases” that require the tenant to pay all the operating costs, costs of maintenance, insurance and real estate taxes on the property. We seek to obtain lease terms of approximately 10 to 15 years with built-in rental increases.

6

Investments in Mortgage Loans

Although we expect to make investments in mortgage loans sparingly, we may elect to structure our investment in a particular property as a mortgage loan secured by the property in situations where a standard net lease transaction would have an adverse tax impact on the seller or would otherwise be inappropriate for us. We anticipate that most of our lending transactions would be loans secured by industrial or commercial property or issued in connection with a build-to-suit transaction. Our Adviser will attempt to structure mortgage loans in a manner that would provide us with current income substantially similar to that which we could expect to receive had the investment been structured as a net lease transaction.

To the extent that we invest in mortgage loans, we will generally originate those loans. However, we may also purchase mortgage loans from banks, CMBS pools or other lenders provided that such transactions are otherwise consistent with our investment objectives. Our Adviser will service the mortgage loans in our portfolio by monitoring the collection of monthly principal and interest payments on our behalf. We currently have one mortgage loan outstanding.

Underwriting Criteria, Due Diligence Process and Negotiating Lease Provisions

We consider underwriting of the real estate and the tenant for the property (or the borrower in the case of a mortgage loan) to be the most important aspects of evaluating a prospective investment. Evaluating the creditworthiness of the tenant or borrower and its ability to generate sufficient cash flow to make payments to us pursuant to the lease or the mortgage loan is the one of the most important aspects of our underwriting procedures. In analyzing potential acquisitions of properties and leases, our Adviser reviews all aspects of the potential transaction, including tenant and real estate fundamentals, to determine whether potential acquisitions and leases can be structured to satisfy our acquisition criteria. The criteria listed below provide general guideposts that our Adviser may consider when underwriting leases and mortgage loans:

| • | Credit Evaluation. Our Adviser evaluates each potential tenant for its creditworthiness, considering factors such as the tenants rating by a national credit rating agency, if any, management experience, industry position and fundamentals, operating history and capital structure. Currently, 34% of our tenants are rated by a national credit rating agency. A prospective tenant that is deemed creditworthy does not necessarily mean that we will consider the tenant’s property to be “investment grade.” Our Adviser seeks tenants that range from small businesses, many of which do not have publicly rated debt, to large public companies. Our Adviser’s investment professionals have substantial experience in locating and financing these types of companies. By leasing properties to these tenants, we believe that we will generally be able to charge rent that is higher than the rent charged to tenants with unleveraged balance sheets and recognized credit, thereby enhancing current return from these properties as compared with properties leased to companies whose credit potential has already been recognized by the market. Furthermore, if a tenant’s credit improves, the value of our lease or investment will likely increase (if all other factors affecting value remain unchanged). In evaluating a possible investment, we believe that the creditworthiness of a prospective tenant is normally a more significant factor than the unleased value of the property itself. While our Adviser selects tenants it believes to be creditworthy, tenants are not required to meet any minimum rating established by an independent credit rating agency. Our Adviser’s standards for determining whether a particular tenant is creditworthy vary in accordance with a variety of factors relating to specific prospective tenants. The creditworthiness of a tenant is determined on a tenant-by-tenant and case-by-case basis. Therefore, general standards for creditworthiness cannot be applied. |

7

| • | Leases with Increasing Rent. Our Adviser seeks to include a clause in each lease that provides for annual rent escalations over the term of the lease. These increases will generally be fixed; however certain of our leases are tied to increases in indices, such as the consumer price index. |

| • | Diversification. Our Adviser attempts to diversify our portfolio to avoid dependence on any one particular tenant, facility type, geographic location or tenant industry. By diversifying our portfolio, our Adviser intends to reduce the adverse effect of a single under-performing investment or a downturn in any particular industry or geographic region. Please see Item 2 of this Form 10-K for a summary of our portfolio by industry and geographic location. |

| • | Property Valuation. The business prospects and the financial strength of the tenant are important aspects of the evaluation of any sale and leaseback of property, or acquisition of property subject to a net lease, particularly a property that is specifically suited to the needs of the tenant. We generally require quarterly unaudited and annual audited financial statements of the tenant in order to continuously monitor the financial performance of the tenant. Our Adviser evaluates the financial capability of the tenant and its ability to perform per the terms of the lease, including obtaining certificates of insurance and verifying payment of real estate taxes on an annual basis. Our Adviser may also examine the available operating results of prospective investment properties to determine whether or not projected rental levels are likely to be met. As further described below, our Advisor also evaluates the physical characteristics of a prospective property investment and comparable properties as well as the geographic location of the property in the particular market to ensure that the characteristics are favorable for re-leasing the property at approximately the same or higher rental rate should that necessity arise. Our Adviser then computes the value of the property based on historical and projected operating results. In addition, each property that we propose to purchase is appraised by an independent appraiser. These appraisals may take into consideration, among other things, the terms and conditions of the particular lease transaction and the conditions of the credit markets at the time the purchase is negotiated. We generally limit the purchase price of each acquisition to less than 10% of our consolidated total assets. |

| • | Properties Important to Tenant Operations. Our Adviser generally seeks to acquire investment properties that are essential or important to the ongoing operations of the prospective tenant. We believe that these investment properties provide better protection in the event a tenant files bankruptcy, as leases on properties essential or important to the operations of a bankrupt tenant are typically less likely to be rejected in bankruptcy or otherwise terminated. |

| • | Lease Provisions that Enhance and Protect Value. When appropriate, our Adviser attempts to include provisions in our leases that require our consent to specified tenant activity or require the tenant to satisfy specific operating tests. These provisions may include, operational or financial covenants of the tenant, as well as indemnification of us by the tenant against environmental and other contingent liabilities. We believe that these provisions serve to protect our investments from changes in the operating and financial characteristics of a tenant that may impact its ability to satisfy its obligations to us or that could reduce the value of our properties. Our Adviser generally also seeks covenants requiring tenants to receive our consent prior to any change in control of the tenant. |

| • | Credit Enhancement. Our Adviser may also seek to enhance the likelihood of a tenant’s lease obligations being satisfied through a cross-default with other tenant obligations, a letter of credit or a guaranty of lease obligations from each tenant’s corporate parent. We believe that this type of credit enhancement, if obtained, provides us with additional financial security. |

8

Underwriting of the Real Estate and Due Diligence Process

In addition to underwriting the tenant or borrower, our Adviser also underwrites the real estate to be acquired or secured by one of our mortgages. On our behalf, our Adviser performs a due diligence review with respect to each property, such as evaluating the physical condition of a property, zoning and site requirements to ensure the property is in compliance with all zoning regulations as well as an environmental site assessment, in an attempt to determine potential environmental liabilities associated with a property prior to its acquisition, although there can be no assurance that hazardous substances or wastes (as defined by present or future federal or state laws or regulations) will not be discovered on the property after we acquire it. We could incur significant costs related to government regulation and private litigation over environmental matters. See “Risk Factors—We could be exposed to liability and remedial costs related to environmental matters.”

Our Adviser also reviews the structural soundness of the improvements on the property and may engage a structural engineer to review multiple aspects of the structures to determine the longevity of each building on the property. This review normally also includes the components of each building, such as the roof, the structure and configuration, the electrical wiring, the heating and air-conditioning system, the plumbing, parking lot and various other aspects such as compliance with state and federal building codes.

Our Adviser also physically inspects the real estate and surrounding real estate as part of determining its value. All of our Adviser’s due diligence is aimed at arriving at a valuation of the real estate under the assumption that it would not be rented to the existing tenant. As part of this process, our Adviser may consider one or more of the following items:

| • | The comparable value of similar real estate in the same general area of the prospective property. In this regard, comparable property is difficult to define because each piece of real estate has its own distinct characteristics. But to the extent possible, comparable property in the area that has sold or is for sale will be used to determine if the price to be paid for the property is reasonable. The question of comparable properties’ sale prices is particularly relevant if a property might be sold by us at a later date. |

| • | An assessment of the relative flexibility of the building configuration and its ability to be re-leased to other users in a single or multiple tenant arrangement. |

| • | The comparable real estate rental rates for similar properties in the same area of the prospective property. |

| • | Alternative property uses that may offer higher value. |

| • | The cost of replacing the property at current construction prices if it were to be sold. |

| • | The assessed value as determined by the local real estate taxing authority. |

In addition, our Adviser supplements its valuation with an independent real estate appraisal in connection with each investment that we consider. When appropriate, our Adviser may engage experts to undertake some or all of the due diligence efforts described above.

Use of Leverage

We use long-term mortgage borrowings as a financing mechanism in amounts that we believe will maximize the return to our stockholders. Currently, the majority of our long-term mortgage borrowings are structured as non-recourse to us, and we intend to structure any medium-term mortgages in the same manner, with limited exceptions that would trigger recourse to us only upon the occurrence of certain fraud, misconduct, environmental or bankruptcy events. The use of non-recourse financing allows us to limit our

9

exposure to the amount of equity invested in the properties pledged as collateral for our borrowings. Non-recourse financing generally restricts a lender’s claim on the assets of the borrower, and as a result, the lender generally may look only to the property securing the debt for its satisfaction. We believe that this financing strategy, to the extent available, protects our other assets. However, we can provide no assurance that non-recourse financing will be available on terms acceptable to us, or at all, and consequently, there may be circumstances where lenders have recourse to our other assets. To a much lesser extent, we use recourse financing. Of the $459.3 million in long-term mortgages outstanding as of December 31, 2014, only $2.0 million is recourse to the Company.

We believe that, by operating on a leveraged basis, we will have more funds available and, therefore, will make more investments than would otherwise be possible if we operated on a non-leveraged basis. We believe that this creates a more diversified portfolio and maximizes potential returns to our stockholders. We may refinance properties during the term of a loan when we believe it is advantageous.

Conflict of Interest Policy

We have adopted policies to reduce potential conflicts of interest. In addition, our directors are subject to certain provisions of Maryland law that are designed to minimize conflicts. However, we cannot assure you that these policies or provisions of law will reduce or eliminate the influence of these conflicts.

Under our current conflict of interest policy, without the approval of a majority of our independent directors, we will not:

| • | acquire from or sell any assets or other property to any of our officers, directors or our Adviser’s employees, or any entity in which any of our officers, directors or Adviser’s employees has an interest of more than 5%; |

| • | borrow from any of our directors, officers or our Adviser’s employees, or any entity, in which any of our officers, directors or our Adviser’s employees has an interest of more than 5%; or |

| • | engage in any other transaction with any of our directors, officers or our Adviser’s employees, or any entity in which any of our directors, officers or our Adviser’s employees has an interest of more than 5% (except that our Adviser may lease office space in a building that we own, provided that the rental rate under the lease is determined by our independent directors to be at a fair market rate). |

Our policy also prohibits us from purchasing any real property owned by or co-investing with our Adviser, any of its affiliates or any business in which our Adviser or any of its subsidiaries have invested, except that we may lease property to existing and prospective portfolio companies of current or future affiliates, such as Gladstone Capital Corporation, Gladstone Land Corporation or Gladstone Investment Corporation and other entities advised by our Adviser, so long as that entity does not control the portfolio company and the transaction is approved by both companies’ board of directors. If we decide to change this policy on co-investments with our Adviser or its affiliates, we will seek our stockholders’ approval.

10

Future Revisions in Policies and Strategies

Our independent directors periodically review our investment policies to evaluate whether they are in the best interests of us and our stockholders. Our investment procedures, objectives and policies may vary as new investment techniques are developed or as regulatory requirements change, and except as otherwise provided in our charter or bylaws, may be altered by a majority of our directors (including a majority of our independent directors) without the approval of our stockholders, to the extent that our Board of Directors determines that such modification is in the best interest of our stockholders. Among other factors, developments in the market which affect the policies and strategies described in this report or which change our assessment of the market may cause our Board of Directors to revise our investment policies and strategies.

Code of Ethics

The Company and its affiliates, including Gladstone Capital Corporation, Gladstone Investment Corporation, Gladstone Land Corporation, Gladstone Management Corporation, Gladstone Administration, LLC, and Gladstone Securities, LLC have adopted a code of ethics and business conduct applicable to all personnel of such companies that complies with the guidelines set forth in Item 406 of Regulation S-K of the Securities Act of 1933, as amended. This code establishes procedures for personal investments, restricts certain transactions by such personnel and requires the reporting of certain transactions and holdings by such personnel. A copy of this code is available for review, free of charge, at our website at www.GladstoneCommercial.com. We intend to provide any required disclosure of any amendments to or waivers of the provisions of this code by posting information regarding any such amendment or waiver to our website within four days of its effectiveness.

Our Adviser and Administrator

Our business is managed by our Adviser. The officers, directors and employees of our Adviser have significant experience in making investments in and lending to businesses of all sizes, and investing in real estate and making mortgage loans. We have entered into an investment advisory agreement with our Adviser, or the Advisory Agreement, under which our Adviser is responsible for managing our assets and liabilities, for operating our business on a day-to-day basis and for identifying, evaluating, negotiating and consummating investment transactions consistent with our investment policies as determined by our Board of Directors from time to time. Gladstone Administration, LLC, or our Administrator, employs our chief financial officer, treasurer, chief compliance officer, general counsel (who also serves as our Administrator’s president) and secretary and their respective staffs and provides administrative services for us under the Administration Agreement.

David Gladstone, our chairman and chief executive officer, is also the chairman, chief executive officer and the controlling stockholder of our Adviser and our Administrator. Terry Lee Brubaker, our vice chairman and chief operating officer and a member of our Board of Directors, also serves in the same capacities for our Adviser and our Administrator. Robert Cutlip, our president, is also an executive managing director of our Adviser.

Our Adviser maintains our investment committee that approves each of our investments. This investment committee is currently comprised of Messrs. Gladstone, Cutlip and Brubaker. We believe that the review process of our investment committee gives us a unique competitive advantage over other REITs because of the substantial experience that its members possess and their unique perspective in evaluating the blend of corporate credit, real estate and lease terms that collectively provide an acceptable risk for our investments.

Our Adviser’s board of directors has empowered our investment committee to authorize and approve our investments, subject to the terms of the Advisory Agreement. Before we acquire any property, the transaction is reviewed by our investment committee to ensure that, in its view, the proposed transaction satisfies our investment criteria and is within our investment policies. Approval by our investment committee is generally the final step in the property acquisition approval process, although the separate

11

approval of our Board of Directors is required in certain circumstances described below. For further detail on this process, please see “Investment Policies—Underwriting Criteria, Due Diligence Process and Negotiating Lease Provisions.”

Our Adviser and Administrator are headquartered in McLean, Virginia, a suburb of Washington, D.C., and our Adviser also has offices in several other states.

Advisory and Administration Agreements

Many of the services performed by our Adviser and Administrator in managing our day-to-day activities are summarized below. This summary is provided to illustrate the material functions which our Adviser and Administrator perform for us pursuant to the terms of the Advisory and Administration Agreements, respectively.

Advisory Agreement

Under the terms of the Advisory Agreement, we are responsible for all expenses incurred for our direct benefit. Examples of these expenses include legal, accounting, interest, directors’ and officers’ insurance, stock transfer services, stockholder-related fees, consulting and related fees. In addition, we are also responsible for all fees charged by third parties that are directly related to our business, which include real estate brokerage fees, mortgage placement fees, lease-up fees and transaction structuring fees (although we may be able to pass some or all of such fees on to our tenants and borrowers).

The Advisory Agreement provides for an annual base management fee equal to 2.0% of our total stockholders’ equity, less the recorded value of any preferred stock, and an incentive fee based on FFO. Our Adviser does not charge acquisition or disposition fees when we acquire or dispose of properties as is common in other externally managed REITs; however, our Adviser may earn fee income from our borrowers, tenants or other sources.

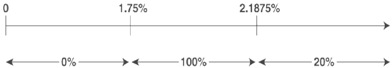

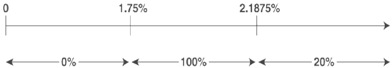

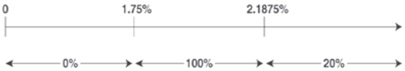

For purposes of calculating the incentive fee, FFO includes any realized capital gains and capital losses, less any distributions paid on preferred stock and convertible senior common stock, but FFO does not include any unrealized capital gains or losses. The incentive fee would reward our Adviser if our quarterly FFO, before giving effect to any incentive fee, or pre-incentive fee FFO, exceeds 1.75%, or the hurdle rate, of total stockholders’ equity, less the recorded value of any preferred stock. We pay our Adviser an incentive fee with respect to our pre-incentive fee FFO quarterly as follows:

| • | no incentive fee in any calendar quarter in which our pre-incentive fee FFO does not exceed the hurdle rate of 1.75% (7% annualized); |

| • | 100% of the amount of the pre-incentive fee FFO that exceeds the hurdle rate, but is less than 2.1875% in any calendar quarter (8.75% annualized); and |

| • | 20% of the amount of our pre-incentive fee FFO that exceeds 2.1875% in any calendar quarter (8.75% annualized). |

12

Quarterly Incentive Fee Based on FFO

Pre-incentive fee FFO

(expressed as a percentage of total common stockholders’ equity)

Percentage of pre-incentive fee FFO allocated to incentive fee

The incentive fee may be reduced because of our Line of Credit covenant which limits distributions to our stockholders to 100% of FFO with acquisition-related costs that are required to be expensed under Accounting Standards Codification, or ASC 805, Business Combinations, added back to FFO.

Administration Agreement

Under the terms of the Administration Agreement, we pay separately for our allocable portion of our Administrator’s overhead expenses in performing its obligations to us including, but not limited to, rent and our allocable portion of the salaries and benefits expenses of our Administrator’s employees, including, but not limited to, our chief financial officer, treasurer, chief compliance officer, general counsel and secretary (who also serves as our Administrator’s president), and their respective staffs. Prior to July 1, 2014, our allocable portion was generally derived by multiplying that portion of the Administrator’s expenses allocable to all funds managed by the Adviser by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all funds managed by the Adviser. As approved by our Board of Directors, effective July 1, 2014, our allocable portion of the Administrator’s expenses are generally derived by multiplying our Administrator’s total expenses by the approximate percentage of time the Administrator’s employees perform services for us in relation to their time spent performing services for all companies serviced by our Administrator under contractual agreements. Management believes that the new methodology of allocating the Administrator’s total expenses by approximate percentage of time services were performed among all companies serviced by our Administrator more closely approximates fees paid to actual services performed.

Adviser Duties and Authority under the Advisory Agreement

Under the terms of the Advisory Agreement, our Adviser is required to use its best efforts to present to us investment opportunities consistent with our investment policies and objectives as adopted by our Board of Directors. In performing its duties, our Adviser, either directly or indirectly by engaging an affiliate:

| • | finds, evaluates and enters into contracts to purchase real estate and make mortgage loans on our behalf in compliance with our investment procedures, objectives and policies, subject to approval of our Board of Directors, where required; |

| • | provides advice to us and acts on our behalf with respect to the negotiation, acquisition, financing, refinancing, holding, leasing and disposition of real estate investments; |

| • | takes the actions and obtains the services necessary to effect the negotiation, acquisition, financing, refinancing, holding, leasing and disposition of real estate investments; and |

| • | provides day-to-day management of our business activities and other administrative services for us as requested by our Board of Directors. |

13

Our Board of Directors has authorized our Adviser to make investments in any property on our behalf without the prior approval of our Board of Directors if the following conditions are satisfied:

| • | our Adviser has obtained an independent appraisal for the property indicating that the total cost of the property does not exceed its appraised value; and |

| • | our Adviser has concluded that the property, in conjunction with our other investments and proposed investments, is reasonably expected to fulfill our investment objectives and policies as established by our Board of Directors then in effect. |

The actual terms and conditions of transactions involving investments in properties and mortgage loans are determined at the sole discretion of our Adviser, subject at all times to compliance with the foregoing requirements. Some types of transactions, however, require the prior approval of our Board of Directors, including a majority of our independent directors, including the following:

| • | loans not secured or otherwise supported by real property; |

| • | any acquisition or mortgage loan which at the time of investment would have a cost exceeding 20% of our total assets; |

| • | transactions that involve conflicts of interest with our Adviser or other affiliates (other than reimbursement of expenses in accordance with the Advisory Agreement); and |

| • | the lease of assets to our Adviser, its affiliates or any of our officers or directors. |

Our Adviser and Administrator also engage in other business ventures and, as a result, their resources are not dedicated exclusively to our business. For example, our Adviser and Administrator also serve as the external adviser or administrator, respectively, to Gladstone Capital Corporation and Gladstone Investment Corporation, both publicly traded business development companies affiliated with us, and Gladstone Land Corporation, a publicly traded agricultural real estate company that is also our affiliate. However, under the Advisory Agreement, our Adviser is required to devote sufficient resources to the administration of our affairs to discharge its obligations under the agreement. The Advisory Agreement is not assignable or transferable by either us or our Adviser without the consent of the other party, except that our Adviser may assign the Advisory Agreement to an affiliate for whom our Adviser agrees to guarantee its obligations to us. Either we or our Adviser may assign or transfer the Advisory Agreement to a successor entity.

Gladstone Securities

Gladstone Securities, LLC, or Gladstone Securities, is a privately held broker dealer registered with the Financial Industry Regulatory Authority and insured by the Securities Investor Protection Corporation. Gladstone Securities is an affiliate of ours, as its parent company is controlled by Mr. David Gladstone, our chairman and chief executive officer. Mr. Gladstone also serves on the board of managers of Gladstone Securities.

Dealer Manager Agreement

In connection with the offering of our convertible senior common stock, or Senior Common Stock, we entered into a Dealer Manager Agreement, dated March 25, 2011, or the Dealer Manager Agreement, with Gladstone Securities, or the Dealer Manager, pursuant to which the Dealer Manager agreed to act as our exclusive dealer manager in connection with the offering. Pursuant to the terms of the Dealer Manager Agreement, the Dealer Manager is entitled to receive a sales commission in the amount of 7.0% of the gross proceeds of the shares of Senior Common Stock sold, plus a dealer manager fee in the amount of 3.0% of the gross proceeds of the shares of Senior Common Stock sold. Gladstone Securities, in its sole and absolute discretion, may re-allocate all of its selling commissions attributable to a participating broker-dealer and may also re-allocate a portion of its dealer manager fee earned in respect of the proceeds

14

generated by the participating broker-dealer to any participating broker-dealer as a non-accountable marketing allowance. In addition, we have agreed to indemnify the Dealer Manager against various liabilities, including certain liabilities arising under the federal securities laws. We made payments of approximately $0.6 million and $0.3 million during the years ended December 31, 2014 and 2013, respectively, to Gladstone Securities pursuant to this agreement, which are reflected as a component of Senior Common Stock costs in the statement of stockholders’ equity. The Dealer Manager Agreement is scheduled to terminate on the earlier of (i) March 28, 2015 or (ii) the date on which 3,000,000 shares of Senior Common Stock are sold pursuant to the Dealer Manager Agreement. We have elected not to renew the program upon termination on March 28, 2015, and thus the Dealer Manager Agreement will simultaneously terminate on March 28, 2015.

Mortgage Financing Arrangement Agreement

We also entered into an agreement with Gladstone Securities, effective June 18, 2013, for it to act as our non-exclusive agent to assist us with arranging mortgage financing for properties we own. In connection with this engagement, Gladstone Securities may from time to time solicit the interest of various commercial real estate lenders or recommend to us third party lenders offering credit products or packages that are responsive to our needs. We pay Gladstone Securities a financing fee in connection with the services it provides to us for securing mortgage financing on any of our properties. The amount of these financing fees, which are payable upon closing of the financing, will be based on a percentage of the amount of the mortgage, generally ranging from 0.15% to a maximum of 1.0% of the mortgage obtained. The amount of the financing fees may be reduced or eliminated, as determined by us and Gladstone Securities, after taking into consideration various factors, including, but not limited to, the involvement of any third party brokers and market conditions. We paid financing fees to Gladstone Securities of $0.1 million for each of the years ended December 31, 2014 and 2013, respectively, on total mortgages secured of $52.1 million and $76.3 million, or 0.27% and 0.18%, respectively. The agreement is scheduled to terminate on August 31, 2015, unless renewed or earlier terminated.

Employees

We do not currently have any employees and do not expect to have any employees in the foreseeable future. Currently, services necessary for our business are provided by individuals who are employees of our Adviser and our Administrator pursuant to the terms of the Advisory Agreement and the Administration Agreement, respectively. Each of our executive officers is an employee or officer, or both, of our Adviser or our Administrator. No employee of our Adviser or our Administrator will dedicate all of his or her time to us. However, we expect that a total of 15 to 20 full time employees of our Adviser and our Administrator will spend substantial time on our matters during calendar year 2015. To the extent that we acquire more investments, we anticipate that the number of employees of our Adviser and our Administrator who devote time to our matters will increase.

As of December 31, 2014, our Adviser and Administrator collectively had 61 full-time employees. A breakdown of these employees is summarized by functional area in the table below:

| Number of Individuals |

Functional Area | |

| 11 | Executive Management | |

| 36 | Investment Management, Portfolio Management and Due Diligence | |

| 14 | Administration, Accounting, Compliance, Human Resources, Legal and Treasury | |

Competition

We compete with a number of other real estate companies and traditional mortgage lenders, many of whom have greater marketing and financial resources than we do. Principal factors of competition in our primary business of investing in and owning leased industrial, commercial and retail real property are the quality of

15

properties, leasing terms, attractiveness and convenience of location. Additionally, our ability to compete depends upon, among other factors, trends of the national and local economies, investment alternatives, financial condition and operating results of current and prospective tenants and borrowers, availability and cost of capital, taxes and governmental regulations.

Available Information

Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments, if any, to those reports filed or furnished with the Securities and Exchange Commission, or SEC, pursuant to Section 13(a) or 15(d) of the Securities Exchange Act are available free of charge through our website at www.GladstoneCommercial.com. A request for any of these reports may also be submitted to us by sending a written request addressed to Investor Relations, Gladstone Commercial Corporation, 1521 Westbranch Drive, Suite 100, McLean, VA 22102, or by calling our toll-free investor relations line at 1-866-366-5745. The public may read and copy materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

16

| Item 1A. | Risk Factors. |

An investment in our securities involves a number of significant risks and other factors relating to our structure and investment objectives. As a result, we cannot assure you that we will achieve our investment objectives. You should consider carefully the following information before making an investment in our securities.

Risks related to our business and properties

Highly leveraged tenants and borrowers may be unable to pay rent or make mortgage payments, which could adversely affect our cash available to make distributions to our stockholders.

Some of our tenants and borrowers may have recently been either restructured using leverage, or acquired in a leveraged transaction. Tenants and borrowers that are subject to significant debt obligations may be unable to make their rent or mortgage payments if there are adverse changes to their businesses or because of the impact of the recent recession. Tenants that have experienced leveraged restructurings or acquisitions will generally have substantially greater debt and substantially lower net worth than they had prior to the leveraged transaction. In addition, the payment of rent and debt service may reduce the working capital available to leveraged entities and prevent them from devoting the resources necessary to remain competitive in their industries.

In situations where management of the tenant or borrower will change after a transaction, it may be difficult for our Adviser to determine with reasonable certainty the likelihood of the tenant’s or borrower’s business success and of its ability to pay rent or make mortgage payments throughout the lease or loan term. These companies generally are more vulnerable to adverse economic and business conditions, and increases in interest rates.

We are subject to the credit risk of our tenants, which in the event of bankruptcy, could adversely affect our results of operations.

We are subject to the credit risk of our tenants . Any bankruptcy of a tenant or borrower could cause:

| • | the loss of lease or mortgage payments to us; |

| • | an increase in the costs we incur to carry the property occupied by such tenant; |

| • | a reduction in the value of our securities; or |

| • | a decrease in distributions to our stockholders. |

Under bankruptcy law, a tenant who is the subject of bankruptcy proceedings has the option of continuing or terminating any unexpired lease. If a bankrupt tenant terminates a lease with us, any claim we might have for breach of the lease (excluding a claim against collateral securing the lease) will be treated as a general unsecured claim. Our claim would likely be capped at the amount the tenant owed us for unpaid rent prior to the bankruptcy unrelated to the termination, plus the greater of one year’s lease payments or 15% of the remaining lease payments payable under the lease (but no more than three years’ lease payments). In addition, due to the long-term nature of our leases and terms providing for the repurchase of a property by the tenant, a bankruptcy court could re-characterize a net lease transaction as a secured lending transaction. If that were to occur, we would not be treated as the owner of the property, but might have additional rights as a secured creditor.

In addition, we may enter into in sale-leaseback transactions, whereby we would purchase a property and then lease the same property back to the person from whom we purchased it. In the event of the bankruptcy of a tenant, a transaction structured as a sale-leaseback may be re-characterized as either a financing or a joint venture, either of which outcomes could adversely affect our business. If the sale-leaseback were re-characterized as a financing, we might not be considered the owner of the property, and as a result would have the status of a creditor in relation to the tenant. In that event, we would no longer have the right to sell

17

or encumber our ownership interest in the property. Instead, we would have a claim against the tenant for the amounts owed under the lease, with the claim arguably secured by the property. The tenant/debtor might have the ability to propose a plan restructuring the term, interest rate and amortization schedule of its outstanding balance. If confirmed by the bankruptcy court, we could be bound by the new terms, and prevented from foreclosing our lien on the property. If the sale-leaseback were re-characterized as a joint venture, we could be treated as a co-venturer with our lessee with regard to the property. As a result, we could be held liable, under some circumstances, for debts incurred by the lessee relating to the property. Either of these outcomes could adversely affect our cash flow and our ability to pay distributions to stockholders.

We may be unable to renew leases, lease vacant space or re-lease space as leases expire, which could adversely affect our business and our ability to make distributions to our stockholders.

If we cannot renew leases, we may be unable to re-lease our properties to other tenants at rates equal to or above the current market rate. Even if we can renew leases, tenants may be able to negotiate lower rates as a result of market conditions. Market conditions may also hinder our ability to lease vacant space in newly developed or redeveloped properties. In addition, we may enter into or acquire leases for properties that are specially suited to the needs of a particular tenant. Such properties may require renovations, tenant improvements or other concessions in order to lease them to other tenants if the initial leases terminate. We may be required to expend substantial funds for tenant improvements and tenant refurbishments to re-lease the vacated space and cannot assure you that we will have sufficient sources of funding available to use in the future for such purposes and therefore may have difficulty in securing a replacement tenant. Any of these factors could adversely impact our financial condition, results of operations, cash flow or our ability to pay distributions to our stockholders.

Net leases may not result in fair market lease rates over time, thereby failing to maximize income and distributions to our stockholders.

A large portion of our rental income comes from triple net leases, which frequently provide the tenant greater discretion in using the leased property than ordinary property leases, such as the right to sublease the property, subject to our approval, to make alterations in the leased premises and to terminate the lease prior to its expiration under specified circumstances. Further, triple net leases are typically for longer lease terms and, thus, there is an increased risk that contractual rental increases in future years will fail to result in fair market rental rates during those years. As a result, our income and distributions to our stockholders could be lower than they would otherwise be if we did not engage in triple net leases.

Multi-tenant properties expose us to additional risks.

Our multi-tenant properties could expose us to the risk that a sufficient number of suitable tenants may not be found to enable the property to operate profitably. This loss of income could cause a material adverse impact to our results of operations and business. Multi-tenant properties are also subject to tenant turnover and fluctuation in occupancy rates, which could affect our operating results. Furthermore, multi-tenant properties expose us to the risk of increased operating expenses, which may occur when the actual cost of taxes, insurance and maintenance at the property exceeds the operating expenses paid by tenants and/or the amounts budgeted.

We face certain risks associated with our build-to-suit activities.

We may (1) provide a developer with either a combination of financing for construction of a build-to-suit property or a commitment to acquire a property upon completion of construction of a build-to-suit property and commencement of rent from the tenant or (2) acquire a property subject to a lease and engage a developer to complete construction of a build-to-suit property as required by the lease. We face uncertainties associated with a developer’s timely performance and timely completion of a project, including the performance or timely completion of contractors and subcontractors. If a developer, contractor or subcontractor fails to perform, we may resort to legal action to compel performance, remove the developer or rescind the purchase or construction contract.

18

We may incur additional risks as we make periodic payments or other advances to developers before completion of construction. These and other factors can result in increased costs of a project or loss of our investment, and may be affected by conditions beyond both our and the developer’s control.

Illiquidity of real estate investments may make it difficult for us to sell properties in response to market conditions and could harm our financial condition and ability to make distributions to our stockholders.

To the extent the properties are not subject to triple-net leases, some significant expenditures, such as real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the investment. Should these events occur, our income and funds available for distribution could be adversely affected. In addition, as a REIT, we may be subject to a 100% tax on net income derived from the sale of property considered to be held primarily for sale to customers in the ordinary course of our business. We may seek to avoid this tax by complying with certain safe harbor rules that generally limit the number of properties we may sell in a given year, the aggregate expenditures made on such properties prior to their disposition, and how long we retain such properties before disposing of them. However, we can provide no assurance that we will always be able to comply with these safe harbors. If compliance is possible, the safe harbor rules may restrict our ability to sell assets in the future and achieve liquidity that may be necessary to fund distributions.

Our real estate investments may include special use and single or multi-tenant properties that may be difficult to sell or re-lease upon tenant defaults or early lease terminations.

We focus our investments on commercial, industrial and retail properties, a number of which include manufacturing facilities, special use storage or warehouse facilities and special use single or multi-tenant properties. These types of properties are relatively illiquid compared to other types of real estate and financial assets. This illiquidity will limit our ability to quickly change our portfolio in response to changes in economic or other conditions. With these properties, if the current lease is terminated or not renewed or, in the case of a mortgage loan, if we take such property in foreclosure, we may be required to renovate the property or to make rent concessions in order to lease the property to another tenant or sell the property. In addition, in the event we are forced to sell the property, we may have difficulty selling it to a party other than the tenant or borrower due to the special purpose for which the property may have been designed.

These and other limitations may affect our ability to sell or re-lease properties without adversely affecting returns to our stockholders.

Many of our tenants are small and medium sized businesses, which exposes us to additional risks unique to these entities.

Leasing real property or making mortgage loans to small and medium-sized businesses exposes us to a number of unique risks related to these entities, including the following:

| • | Small and medium-sized businesses may have limited financial resources and may not be able to make their lease or mortgage payments on a timely basis, or at all. A small or medium-sized tenant or borrower may be more likely to have difficulty making its lease or mortgage payments when it experiences adverse events, such as the failure to meet its business plan, a downturn in its industry or negative economic conditions because its financial resources may be more limited. |

| • | Small and medium-sized businesses typically have narrower product lines and smaller market shares than large businesses. Because our target tenants and borrowers are typically smaller businesses that may have narrower product lines and smaller market share, they may be more vulnerable to competitors’ actions and market conditions, as well as general economic downturns. |

19

| • | There is generally little or no publicly available information about our target tenants and borrowers. Many of our tenants and borrowers are likely to be privately owned businesses, about which there is generally little or no publicly available operating and financial information. As a result, we will rely on our Adviser to perform due diligence investigations of these tenants and borrowers, their operations and their prospects. We may not learn all of the material information we need to know regarding these businesses through our investigations. |

| • | Small and medium-sized businesses generally have less predictable operating results. We expect that many of our tenants and borrowers may experience significant fluctuations in their operating results, may from time to time be parties to litigation, may be engaged in rapidly changing businesses with products subject to a substantial risk of obsolescence, may require substantial additional capital to support their operations, to finance expansion or to maintain their competitive positions, may otherwise have a weak financial position or may be adversely affected by changes in the business cycle. |

| • | Small and medium-sized businesses are more likely to be dependent on one or two persons. Typically, the success of a small or medium-sized business also depends on the management talents and efforts of one or two persons or a small group of persons. The death, disability or resignation of one or more of these persons could have a material adverse impact on our tenant or borrower and, in turn, on us. |

Our real estate investments have a limited number of tenants and are concentrated in a limited number of industries, which subjects us to an increased risk of significant loss if any one of these tenants is unable to pay or if particular industries experience downturns.

As of December 31, 2014, we owned 96 properties and had 91 tenants in these properties, and our 5 largest tenants accounted for approximately 18.0% of our total rental income. A consequence of a limited number of tenants is that the aggregate returns we realize may be materially adversely affected by the unfavorable performance of a small number of tenants. We do not have fixed guidelines for industry concentration and our investments could potentially be concentrated in relatively few industries. As of December 31, 2014, 17.7% of our total rental income was earned from tenants in the telecommunications industry, 12.2% was earned from tenants in the healthcare industry, and 12.1% was earned from tenants in the automobile industry. As a result, a downturn in an industry in which we have invested a significant portion of our total assets could have a material adverse effect on us.

Healthcare reform legislation may affect our results of operations and financial condition.

In 2010, the President of the United States signed into law the Patient Protection and Affordable Care Act of 2010 and the Health Care and Education Reconciliation Act, which in part modified the Patient Protection and Affordable Care Act (collectively the “Acts”). Together, the Acts serve as the primary vehicle for comprehensive health care reform in the U.S. and are intended to reduce the number of individuals in the U.S. without health insurance and effect significant other changes to the ways in which health care is organized, delivered and reimbursed. The complexities and ramifications of the new legislation are significant, and have begun being implemented through a phased approach that will conclude in 2018. At this time, the effects of health care reform and its impact on our tenants’ business, results of operations and financial condition and the resulting impact on our operations cannot be determined. The Acts could adversely affect the financial and operational performance of our tenants in the healthcare industry specifically and increase the cost of providing healthcare coverage for all tenants generally and could adversely affect the financial and operational performance of our tenants and their results of operations. This may result in a decreased ability of our tenants to make lease payments, and thereby adversely affect our liquidity, financial condition, results of operations and ability to pay distributions to our stockholders.

20

The inability of a tenant in a single tenant property to pay rent will reduce our revenues and increase our carrying costs of the building.

Since most of our properties are occupied by a single tenant, the success of each investment will be materially dependent on the financial stability of these tenants. If a tenant defaults, our rental revenues would be reduced and our expenses associated with carrying the property would increase, as we would be responsible for payments such as taxes and insurance. Lease payment defaults by these tenants could adversely affect our cash flows and cause us to reduce the amount of distributions to stockholders. In the event of a default by a tenant, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and re-leasing our property. If a lease is terminated, there is no assurance that we will be able to lease the property for the rent previously received or sell the property without incurring a loss.

Liability for uninsured losses could adversely affect our financial condition.

Losses from disaster-type occurrences (such as wars, floods or earthquakes) may be either uninsurable or not insurable on economically viable terms. Should such a loss occur, we could lose our capital investment or anticipated profits and cash flow from one or more properties.

We could incur significant costs related to government regulation and private litigation over environmental matters.

Under various environmental laws, including the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, a current or previous owner or operator of real property may be liable for contamination resulting from the release or threatened release of hazardous or toxic substances or petroleum at that property, and an entity that arranges for the disposal or treatment of a hazardous or toxic substance or petroleum at another property may be held jointly and severally liable for the cost to investigate and clean up such property or other affected property. Such parties are known as potentially responsible parties, or PRPs. Environmental laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of the contaminants, and the costs of any required investigation or cleanup of these substances can be substantial. PRPs are liable to the government as well as to other PRPs who may have claims for contribution. The liability is generally not limited under such laws and could exceed the property’s value and the aggregate assets of the liable party. The presence of contamination or the failure to remediate contamination at our properties also may expose us to third-party liability for personal injury or property damage, or adversely affect our ability to sell, lease or develop the real property or to borrow using the real property as collateral.

Environmental laws also impose ongoing compliance requirements on owners and operators of real property. Environmental laws potentially affecting us address a wide variety of matters, including, but not limited to, asbestos-containing building materials, storage tanks, storm water and wastewater discharges, lead-based paint, wetlands and hazardous wastes. Failure to comply with these laws could result in fines and penalties and/or expose us to third-party liability. Some of our properties may have conditions that are subject to these requirements, and we could be liable for such fines or penalties and/or liable to third parties for those conditions.

We could be exposed to liability and remedial costs related to environmental matters.

Certain of our properties may contain, or may have contained, asbestos-containing building materials, or ACBMs. Environmental laws require that ACBMs be properly managed and maintained and may impose fines and penalties on building owners and operators for failure to comply with these requirements. Also, certain of our properties may contain, or may have contained, or are adjacent to or near other properties that have contained or currently contain storage tanks for the storage of petroleum products or other hazardous or toxic substances. These operations create a potential for the release of petroleum products or other hazardous or toxic substances. Certain of our properties may contain, or may have contained, elevated radon levels. Third parties may be permitted by law to seek recovery from owners or operators for property damage and/or personal injury associated with exposure to contaminants, including, but not limited to, petroleum products, hazardous or toxic substances and asbestos fibers. Also, certain of our properties may

21

contain regulated wetlands that can delay or impede development or require costs to be incurred to mitigate the impact of any disturbance. Absent appropriate permits, we can be held responsible for restoring wetlands and be required to pay fines and penalties.

Certain of our properties may contain, or may have contained, microbial matter such as mold and mildew. The presence of microbial matter could adversely affect our results of operations. In addition, if any of our property is not properly connected to a water or sewer system, or if the integrity of such systems are breached, or if water intrusion into our buildings otherwise occurs, microbial matter or other contamination can develop. When excessive moisture accumulates in buildings or on building materials, mold growth may occur, particularly if the moisture problem remains undiscovered or is not addressed over a period of time. Some molds may produce airborne toxins or irritants. If this were to occur, we could incur significant remedial costs and we may also be subject to material private damage claims and awards. Concern about indoor exposure to mold has been increasing, as exposure to mold may cause a variety of adverse health effects and symptoms, including allergic or other reactions. If we become subject to claims in this regard, it could materially and adversely affect us and our future insurability for such matters.

The assessments we perform on our acquisition of property may fail to reveal all environmental conditions, liabilities or compliance concerns. Material environmental conditions, liabilities or compliance concerns may have arisen after the assessments were conducted or may arise in the future, and future laws, ordinances or regulations may impose material additional environmental liability. We cannot assure you that costs of future environmental compliance will not affect our ability to make distributions or that such costs or other remedial measures will not be material to us.

Our properties may be subject to impairment charges, which could adversely affect our results of operations.

We are required to periodically evaluate our properties for impairment indicators. A property’s value is considered impaired if management’s estimate of the aggregate future cash flows (undiscounted and without interest charges) to be generated by the property, based upon its intended use, is less than the carrying value of the property. These estimates of cash flows are based upon factors such as expected future operating income, trends and prospects, as well as the effects of interest and capitalization rates, demand and occupancy, competition and other factors. These factors may result in uncertainty in valuation estimates and instability in the estimated value of our properties which, in turn, could result in a substantial decrease in the value of the properties and significant impairment charges.