GLADSTONE COMMERCIAL CORPORATION

1521 Westbranch Drive, Suite 100

McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 2, 2024

To the Stockholders of Gladstone Commercial Corporation:

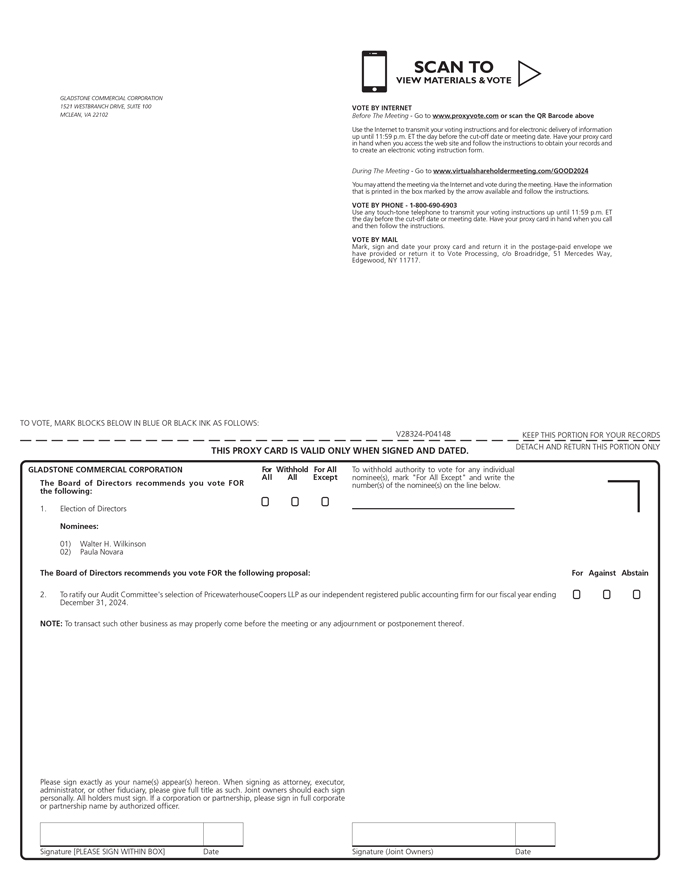

We are notifying you that the 2024 Annual Meeting of Stockholders of Gladstone Commercial Corporation will be held on Thursday, May 2, 2024, at 11:00 a.m. Eastern Daylight Time. To maximize stockholder participation and provide a consistent experience regardless of location, the 2024 Annual Meeting of Stockholders will be a completely “virtual meeting” via live webcast over the Internet. You will be able to attend the meeting as well as vote and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/GOOD2024 and entering the company number and control number included in your “Notice of Internet Availability of Proxy Materials” on your proxy card or in the instructions that accompanied your proxy materials.

At the 2024 Annual Meeting of Stockholders, you will be asked to consider and vote upon the following proposals:

| 1. | To elect two directors to hold office for terms that will expire at the 2027 Annual Meeting of Stockholders and when their respective successors are duly elected and qualified; |

| 2. | To ratify the Audit Committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and |

| 3. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 8, 2024, as the record date for determining the stockholders entitled to notice of and to vote at the 2024 Annual Meeting of Stockholders and at any adjournment or postponement thereof.

Pursuant to rules adopted by the Securities and Exchange Commission, we are providing access to our proxy materials over the Internet. As a result, we are mailing to our stockholders a “Notice of Internet Availability of Proxy Materials,” which contains instructions on how stockholders can access those documents over the Internet and vote their shares. The Notice of Internet Availability of Proxy Materials also contains instructions on how stockholders can receive a paper copy of our proxy materials, including this Proxy Statement, our 2023 Annual Report, and a proxy card or voting instruction card. We believe this process will expedite stockholders’ receipt of proxy materials, lower the costs of our 2024 Annual Meeting of Stockholders and conserve natural resources.

| By Order of the Board of Directors, |

|

|

| Michael LiCalsi |

| Secretary |

McLean, Virginia

March 15, 2024

| The Board of Directors is soliciting proxies to be used at the 2024 Annual Meeting of Stockholders. All of our stockholders are cordially invited to attend the Annual Meeting via webcast. Whether or not you plan to attend the Annual Meeting, you are urged to submit your proxy electronically via the Internet or by telephone as instructed in these materials. Submitting your proxy or voting instructions promptly will assist us in reducing the expenses of additional proxy solicitation, but it will not affect your right to vote if you attend the virtual Annual Meeting via webcast (and, if you are not a stockholder of record, if you have obtained a legal proxy from the bank, broker, trustee or other nominee that holds your shares giving you the right to vote the shares at the virtual Annual Meeting). |