US_ACTIVE\131140259\V-4 September 18, 2025 KeyBank National Association, as Agent 127 Public Square, 8th floor Cleveland, OH 44114 Attn: Michael P. Szuba KeyBank National Association, as Agent 4910 Tiedeman Road, 3rd Floor Brooklyn, Ohio 44144 Attn: KeyBank Real Estate Capital Ladies and Gentlemen: Pursuant to the provisions of §2.11 of the Fourth Amended and Restated Credit Agreement dated as of August 18, 2022 (as varied, extended, supplemented, consolidated, replaced, increased, renewed, modified or amended from time to time, the “Credit Agreement”), by and among Gladstone Commercial Limited Partnership, a Delaware limited partnership (“Borrower”), Gladstone Commercial Corporation, a Maryland corporation (“Parent”), KeyBank National Association (“KeyBank”), as Agent, and each of the financial institutions initially a signatory thereto together with their assignees pursuant to §18 of the Credit Agreement, the Borrower hereby requests an increase in the Total Commitment (as defined in the Credit Agreement) as further set forth below. 1. In connection with the request for such increase, the Borrower hereby certifies and agrees as follows: (a) Request for Increase. The Borrower hereby requests an increase of the Total Revolving Credit Commitment from $125,000,000.00 to $155,000,000.00 (the “Increase”). (b) Certifications. In connection with the Increase, each of Borrower, Parent, and the entities listed on the signature pages hereof as “Subsidiary Guarantors” (hereinafter referred to individually as a “Subsidiary Guarantor” and collectively, as “Subsidiary Guarantors”; Parent and the Subsidiary Guarantors are sometimes hereinafter referred to individually as a “Guarantor” and collectively as “Guarantors”) certifies that: (i) As of the effective date of the Increase, both immediately before and after giving effect to the Increase, there shall exist no Default or Event of Default; (ii) As of the date hereof, the representations and warranties made by the Borrower and Guarantors in the Loan Documents or otherwise made by or on behalf of the Borrower, the Guarantors and the Unencumbered Property Subsidiaries in connection therewith or after the date thereof were true and correct in all material respects when made, are true and correct in all material respects as of the date hereof, and shall be true and correct in all material respects as of the effective date of the Increase, as though such representations and warranties were made on and as of that date (except to the extent of any changes resulting from transactions permitted by the Credit Agreement, and except to the extent such representations relate expressly

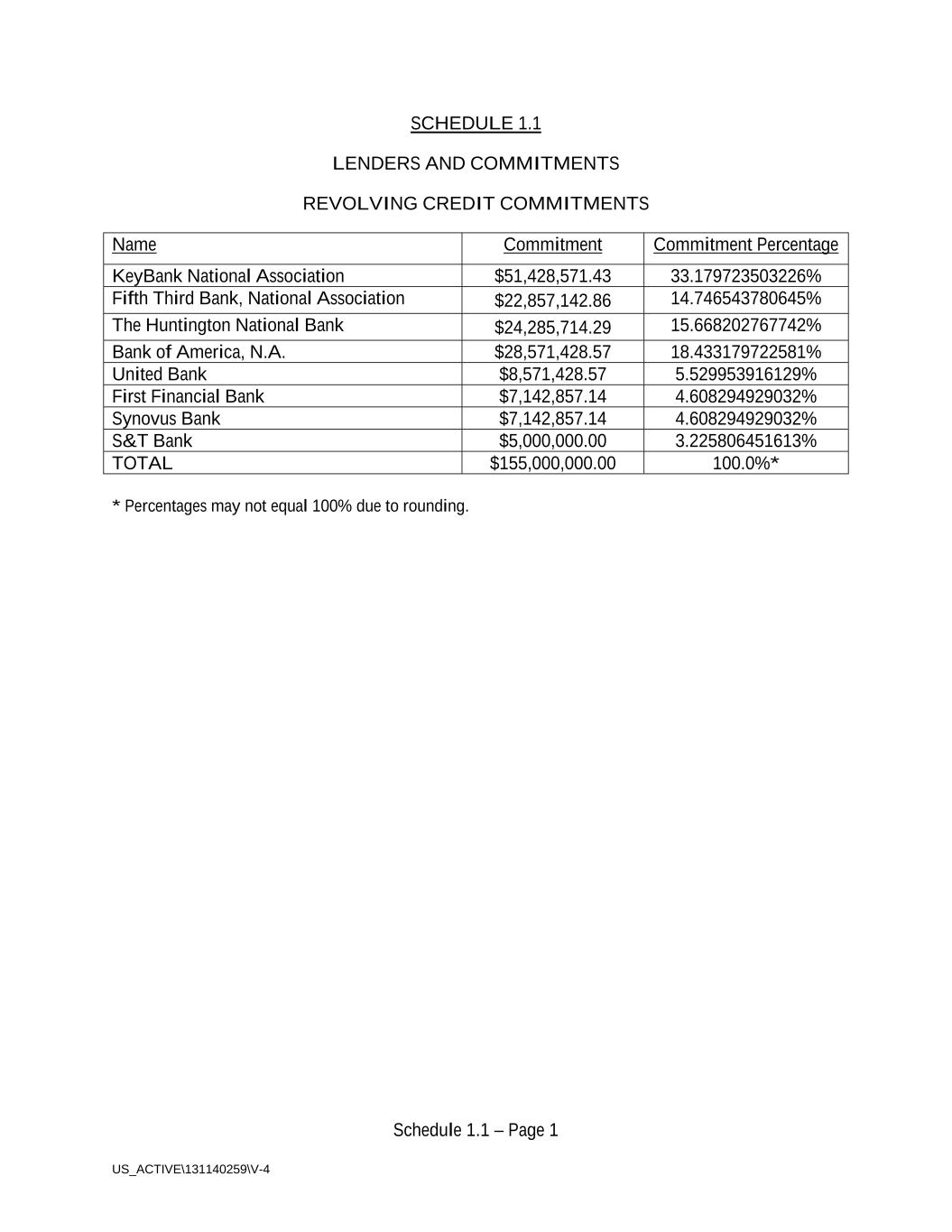

KeyBank National Association, as Agent September 18, 2025 Page - 2 - US_ACTIVE\131140259\V-4 to an earlier date, which representations shall be required to be true and correct only as of such specified date), both immediately before and after giving effect to the Increase, in each case, without duplication of any materiality qualifier contained in such representations and warranties; and (iii) Borrower has paid all fees required by the Agreement Regarding Fees in respect of the Increase and such other fees as required by §2.11(d)(i) of the Credit Agreement in respect of the Increase. (c) Commitments. Borrower hereby acknowledges and agrees that as of the effective date of the Increase and following satisfaction of all conditions precedent thereto as provided in §2.11(d) of the Credit Agreement, the amount of each Revolving Credit Lender’s Revolving Credit Commitment shall be the amount set forth on Schedule 1.1 attached hereto and the Total Revolving Credit Commitment under the Credit Agreement will include the Increase. In connection with the Increase, KeyBank shall be issued a new Revolving Credit Note in the amount of its Revolving Credit Commitment (the “New Note”), which shall, upon acceptance thereof by KeyBank, constitute a “Revolving Credit Note” under the Credit Agreement. (d) Other Conditions. All other conditions to the Increase set forth in §2.11 of the Credit Agreement have been satisfied. 2. Guaranty. The Guarantors acknowledge and agree that upon the effectiveness of the Increase, the New Note described in Paragraph 1(c) above shall be, as provided in the Guaranty, included in the definition of “Note” and be a part of the “Guaranteed Obligations” (as each such term is defined in the Guaranty) under the Guaranty. 3. Definitions. Except as expressly provided in Section 3, capitalized terms used herein which are not otherwise defined herein shall have the meanings set forth in the Credit Agreement. 4. References to Loan Documents. All references in the Loan Documents to the Credit Agreement shall be deemed a reference to the Credit Agreement as supplemented by this Letter Agreement. 5. Consent and Acknowledgment of Borrower and Guarantors. By execution of this letter agreement, the Guarantors hereby expressly consent to the transactions relating to the Credit Agreement as set forth herein and any other agreements or instruments executed in connection herewith, and the Borrower and the Guarantors hereby acknowledge, represent and agree that (a) the Credit Agreement, as supplemented hereby, and the other Loan Documents remain in full force and effect and constitute the valid and legally binding obligation of the Borrower and the Guarantors, as applicable, enforceable against such Persons in accordance with their respective terms, (b) that the Guaranty extends to and applies to the Credit Agreement as supplemented hereby, and (c) that the execution and delivery of this letter agreement and any other agreements or instruments executed in connection herewith does not constitute, and shall

KeyBank National Association, as Agent September 18, 2025 Page - 3 - US_ACTIVE\131140259\V-4 not be deemed to constitute, a release, waiver or satisfaction of Borrower’s or any Guarantor’s obligations under the Loan Documents. 6. Increase Letter as Loan Document. This letter agreement shall constitute a Loan Document. 9. GOVERNING LAW. THIS LETTER AGREEMENT SHALL BE DEEMED TO BE A CONTRACTUAL OBLIGATION UNDER, AND SHALL, PURSUANT TO NEW YORK GENERAL OBLIGATIONS LAW SECTION 5-1401, BE GOVERNED BY AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

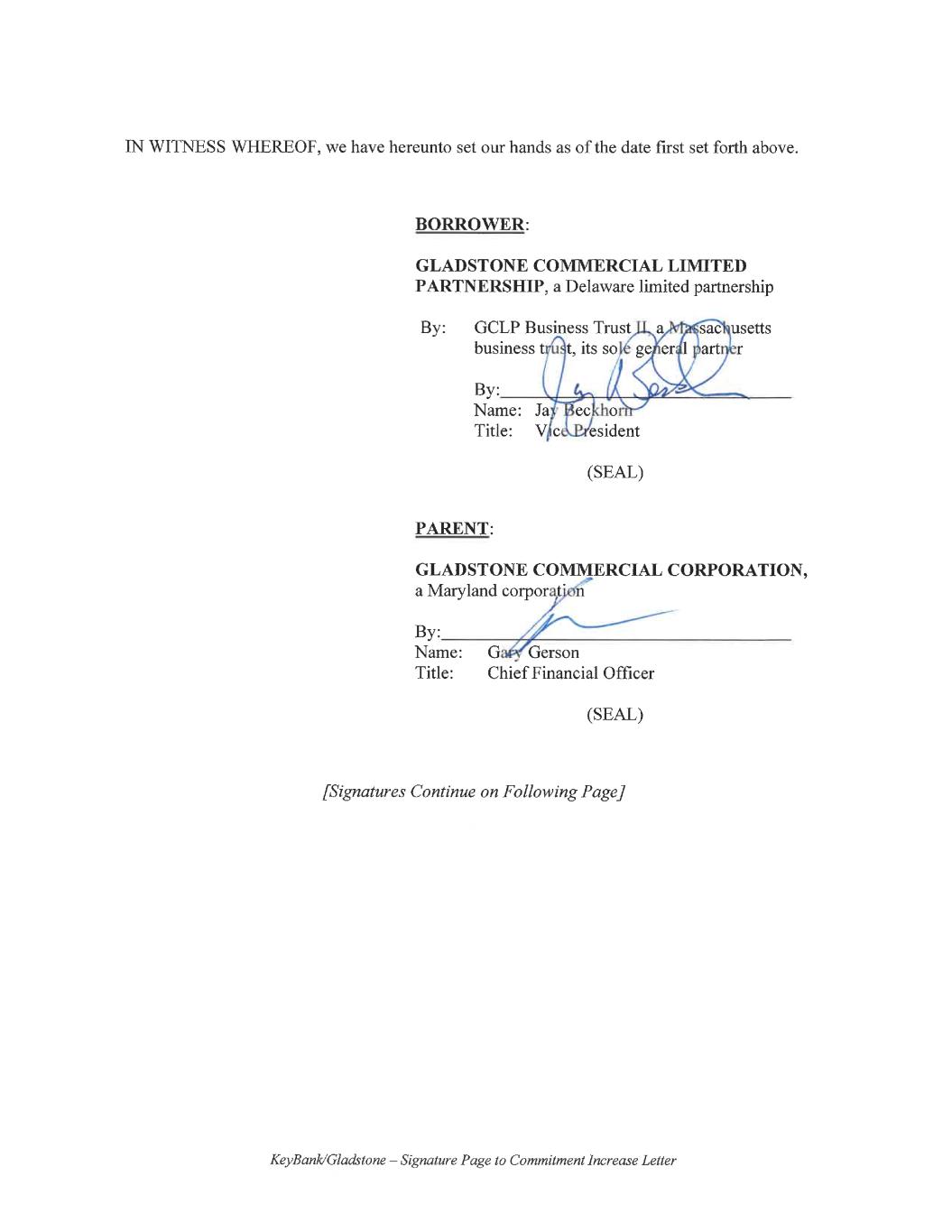

Schedule 1.1 – Page 1 US_ACTIVE\131140259\V-4 SCHEDULE 1.1 LENDERS AND COMMITMENTS REVOLVING CREDIT COMMITMENTS Name Commitment Commitment Percentage KeyBank National Association $51,428,571.43 33.179723503226% Fifth Third Bank, National Association $22,857,142.86 14.746543780645% The Huntington National Bank $24,285,714.29 15.668202767742% Bank of America, N.A. $28,571,428.57 18.433179722581% United Bank $8,571,428.57 5.529953916129% First Financial Bank $7,142,857.14 4.608294929032% Synovus Bank $7,142,857.14 4.608294929032% S&T Bank $5,000,000.00 3.225806451613% TOTAL $155,000,000.00 100.0%* * Percentages may not equal 100% due to rounding.